| Crypto &

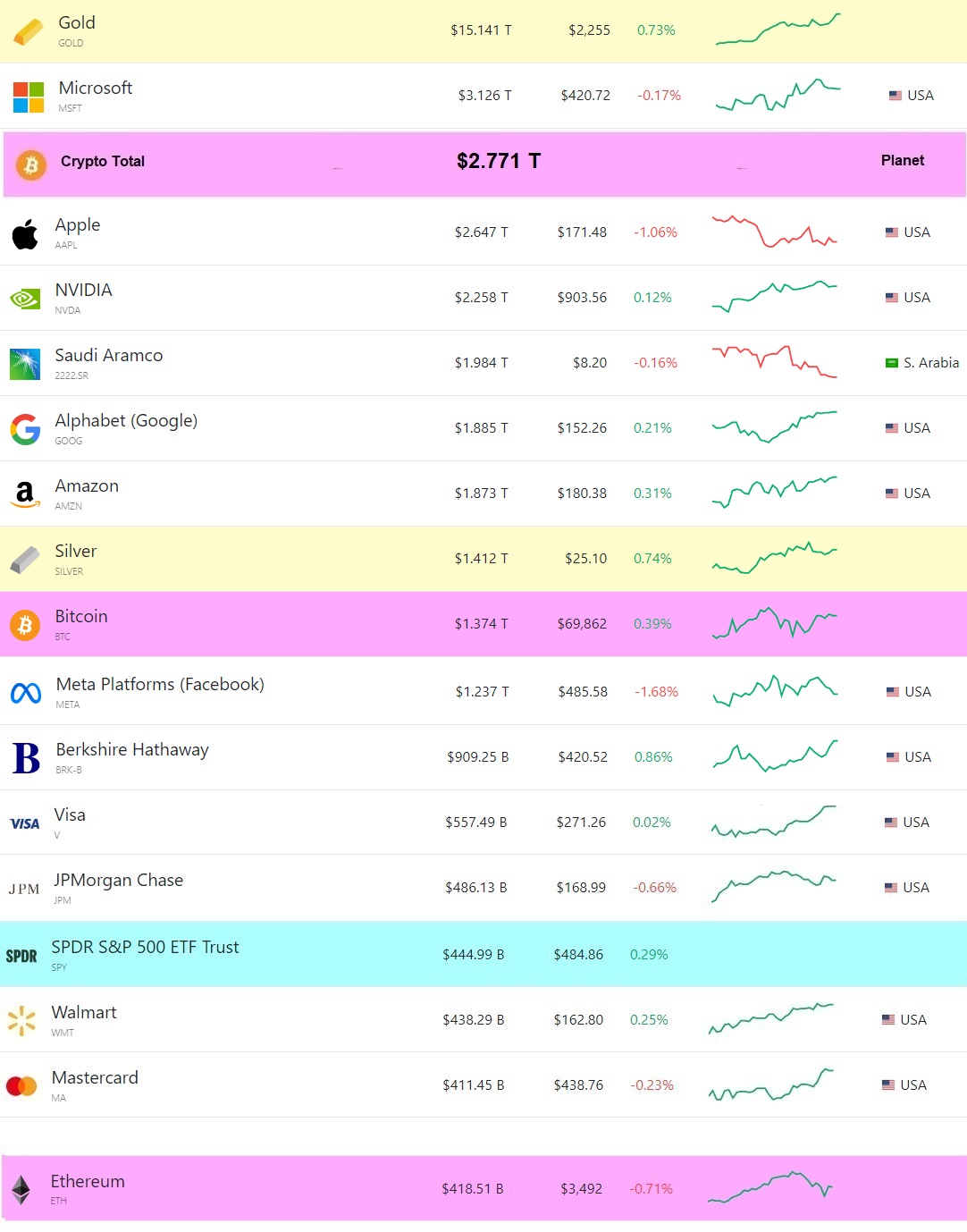

Bitcoin Market Cap Crypto & Bitcoin Market Cap close to the Top of the World - $3.42Trillion

Peak Detector |

■ Bitso YT1

■ ByBit

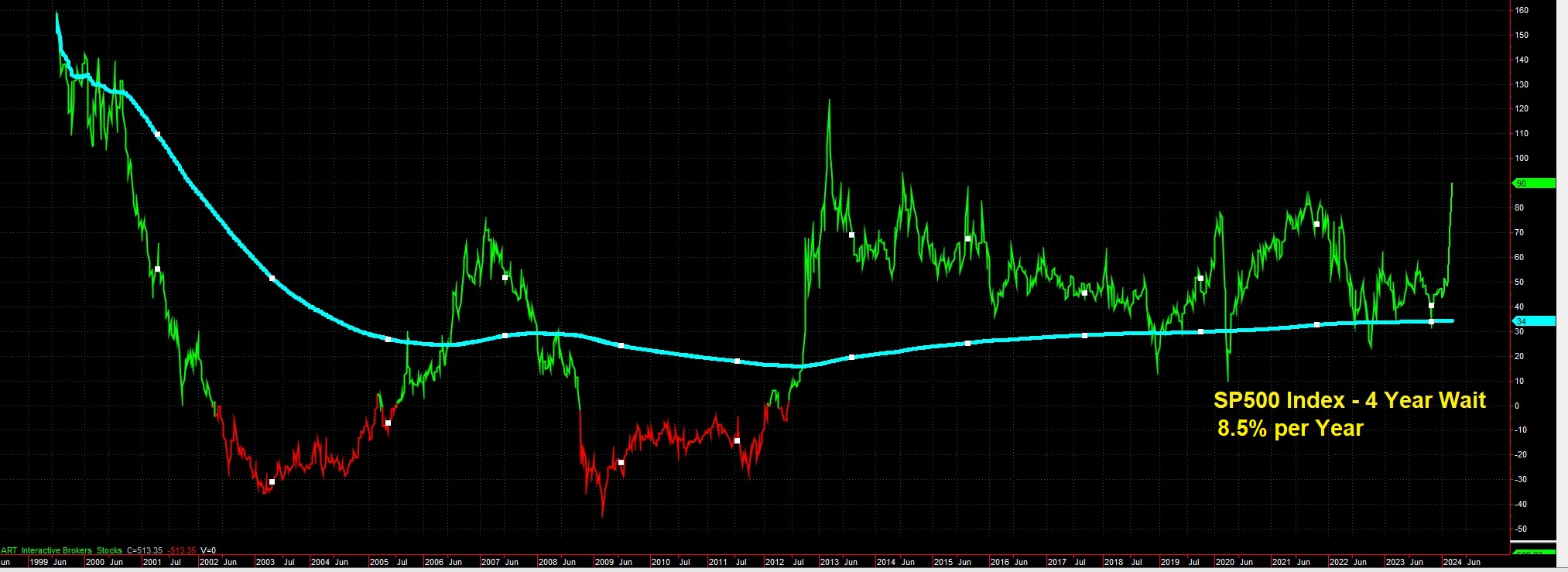

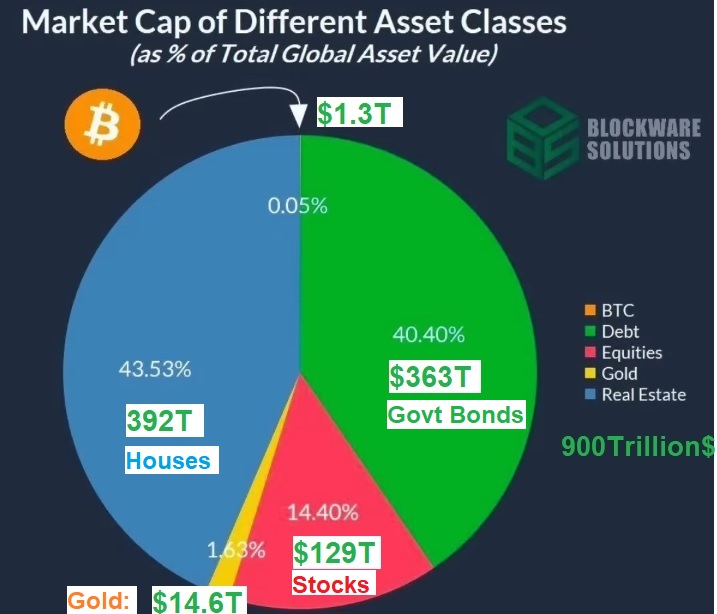

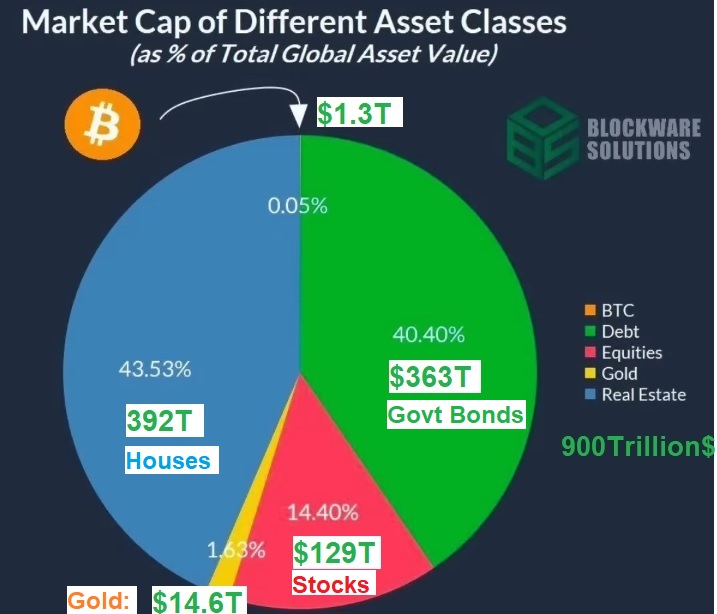

■ A total of 900$Trillion of Investment Funds is looking for the best Investments:

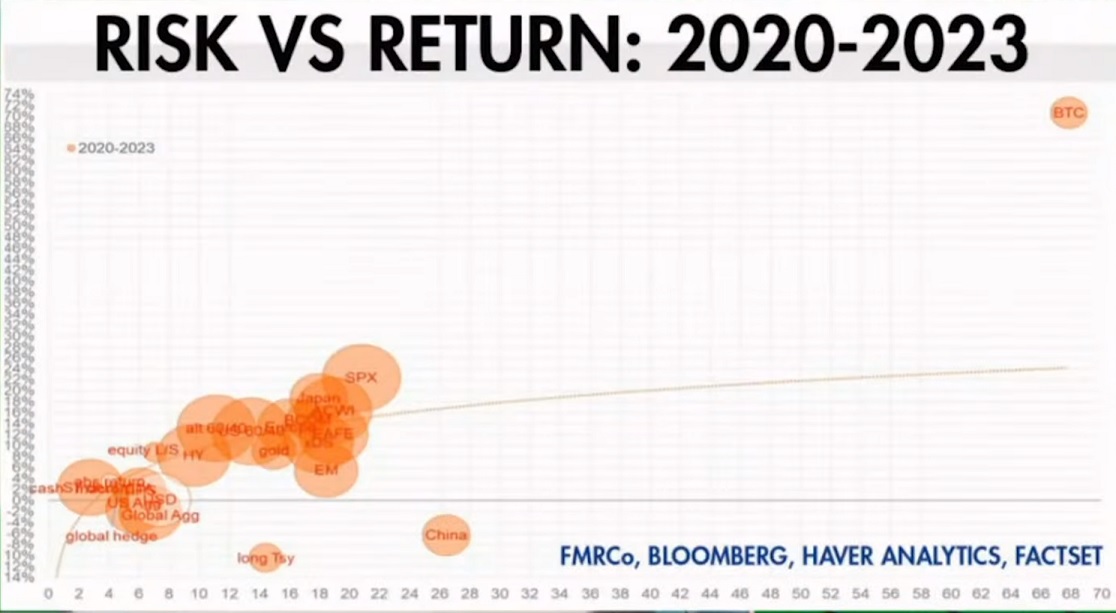

Below is an overview of the main investment options and their 4 years returns: (all show some periods of losses!)

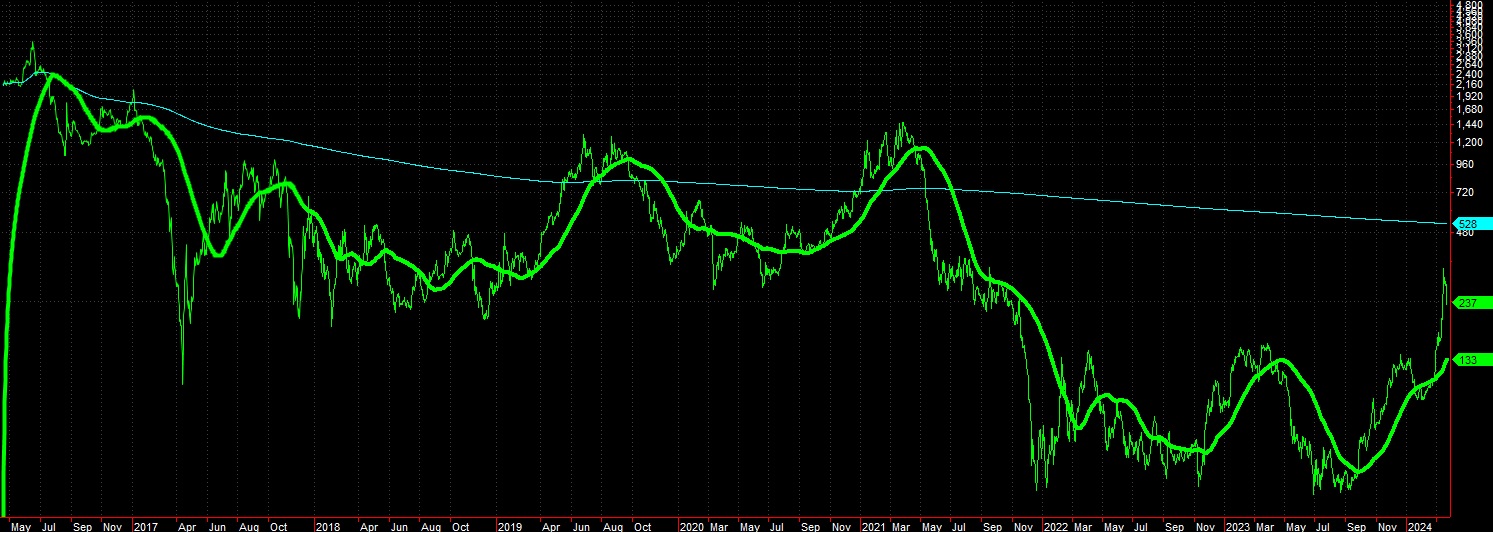

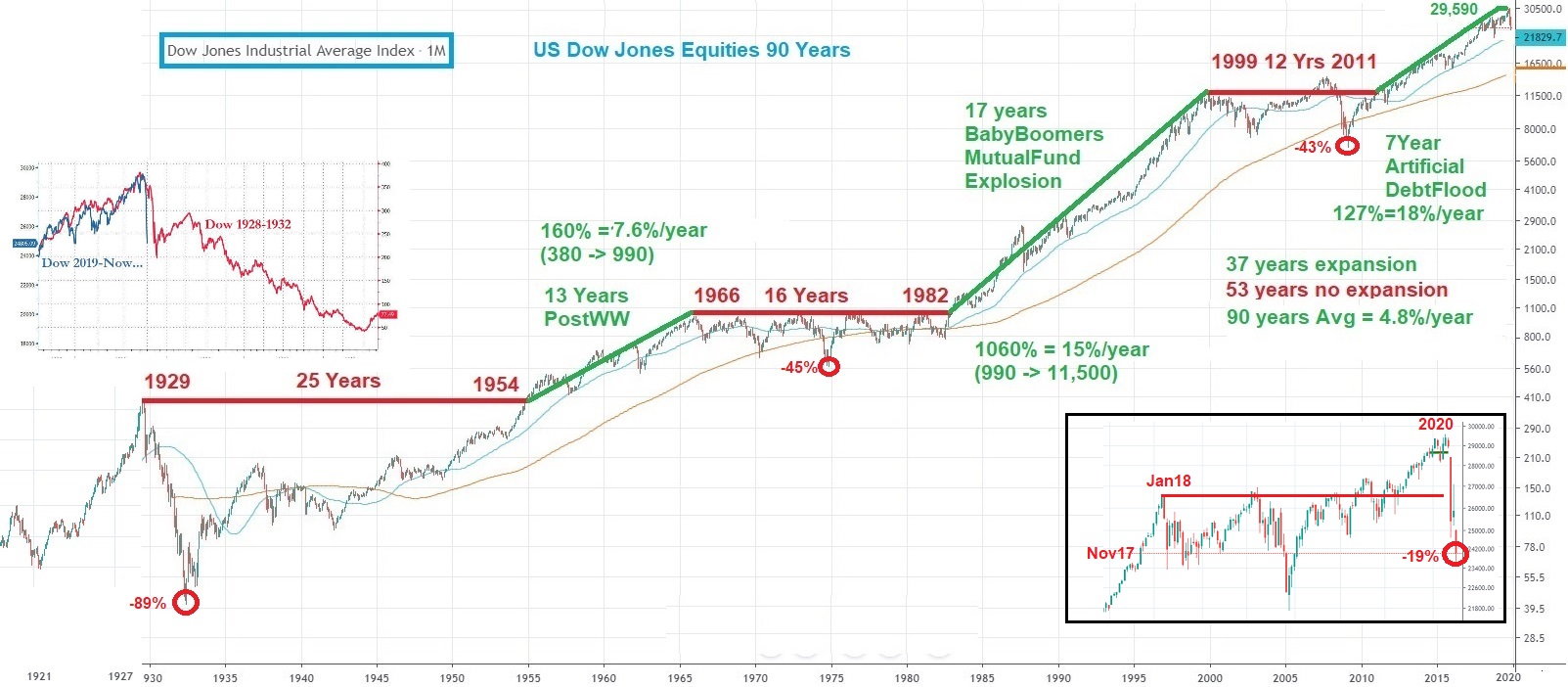

Dow Jones Stock Index 4 Year Returns:

Shows many dangerous drawdowns of 35%(2008, 1980, 1975, 1968) or even 85% (1933):

The last 90 Years in the Stock Market(Dow Jones) have had a 25 year period with a 89% loss (1931) - are you ready for that again?

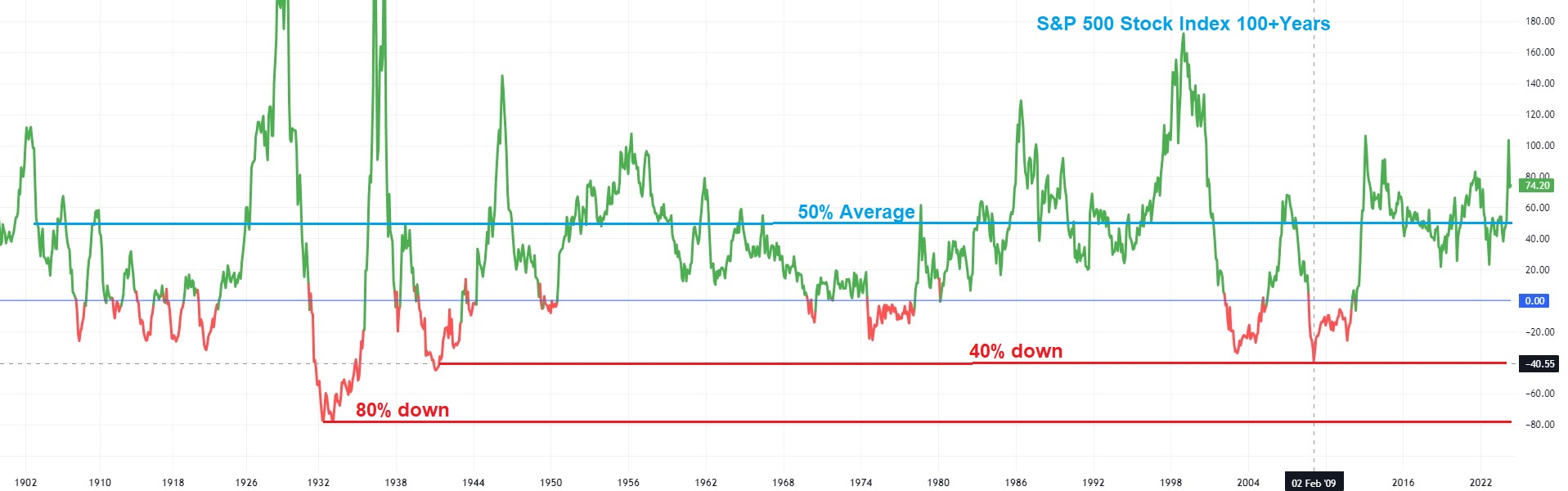

S&P500 Stock Index 4 Year Returns:

Shows many dangerous drawdowns of 40%(2009, 2003, 1974) or even 80% (1932):

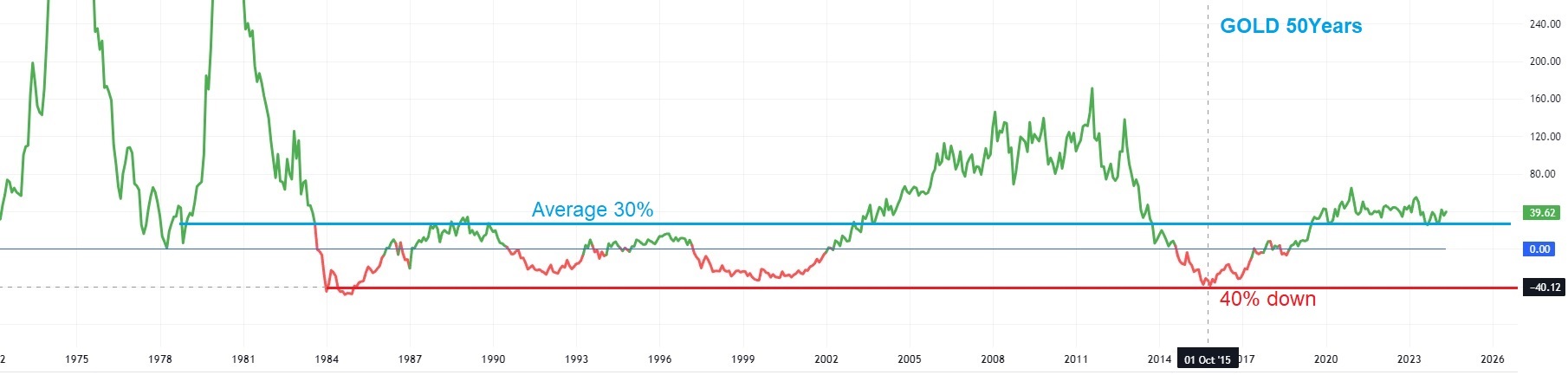

Gold 4 Year Returns:

Shows many dangerous drawdowns of 40%(2015, 2000, 1992, 1985)

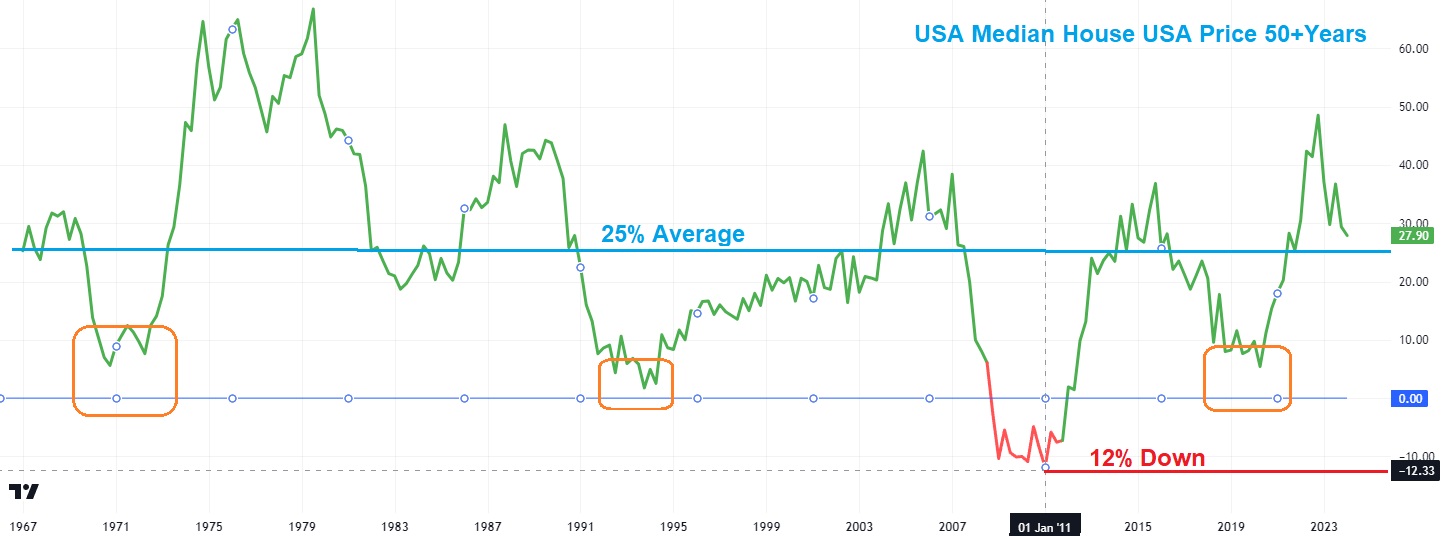

USA Median Housing Price(MSPUS) 4 Year Returns:

Shows a dangerous drawdown of 12%(2011) and a few near zero returns (1971, 1993, 2020)

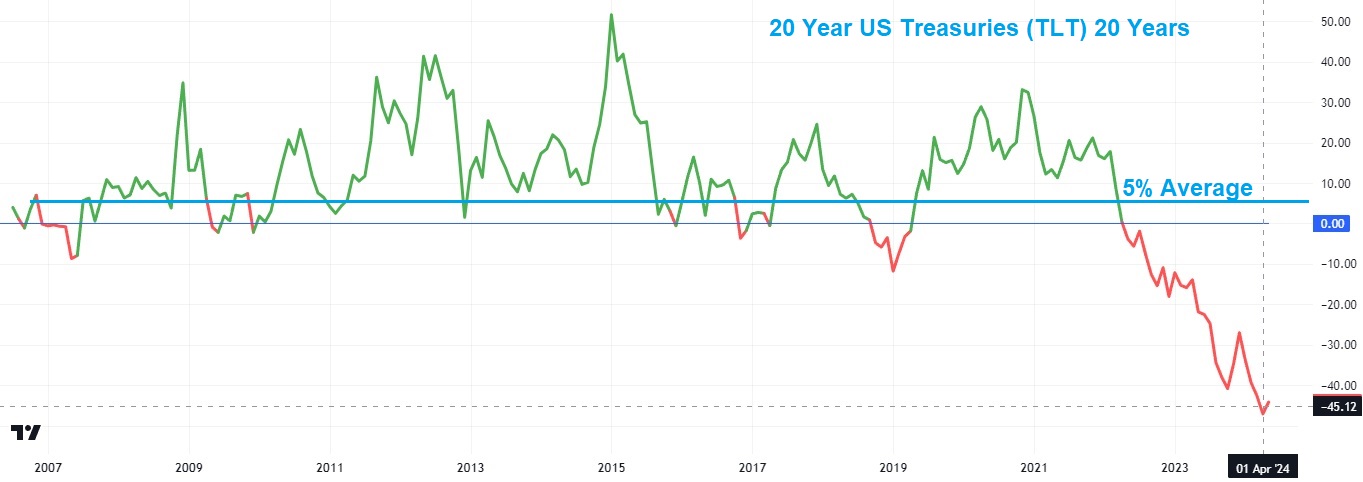

20 Year US Treasuries (TLT) 4 Year Returns:

Shows many dangerous drawdowns of 40%(2015, 2000, 1992, 1985)

Gold is NOT protecting against inflation:

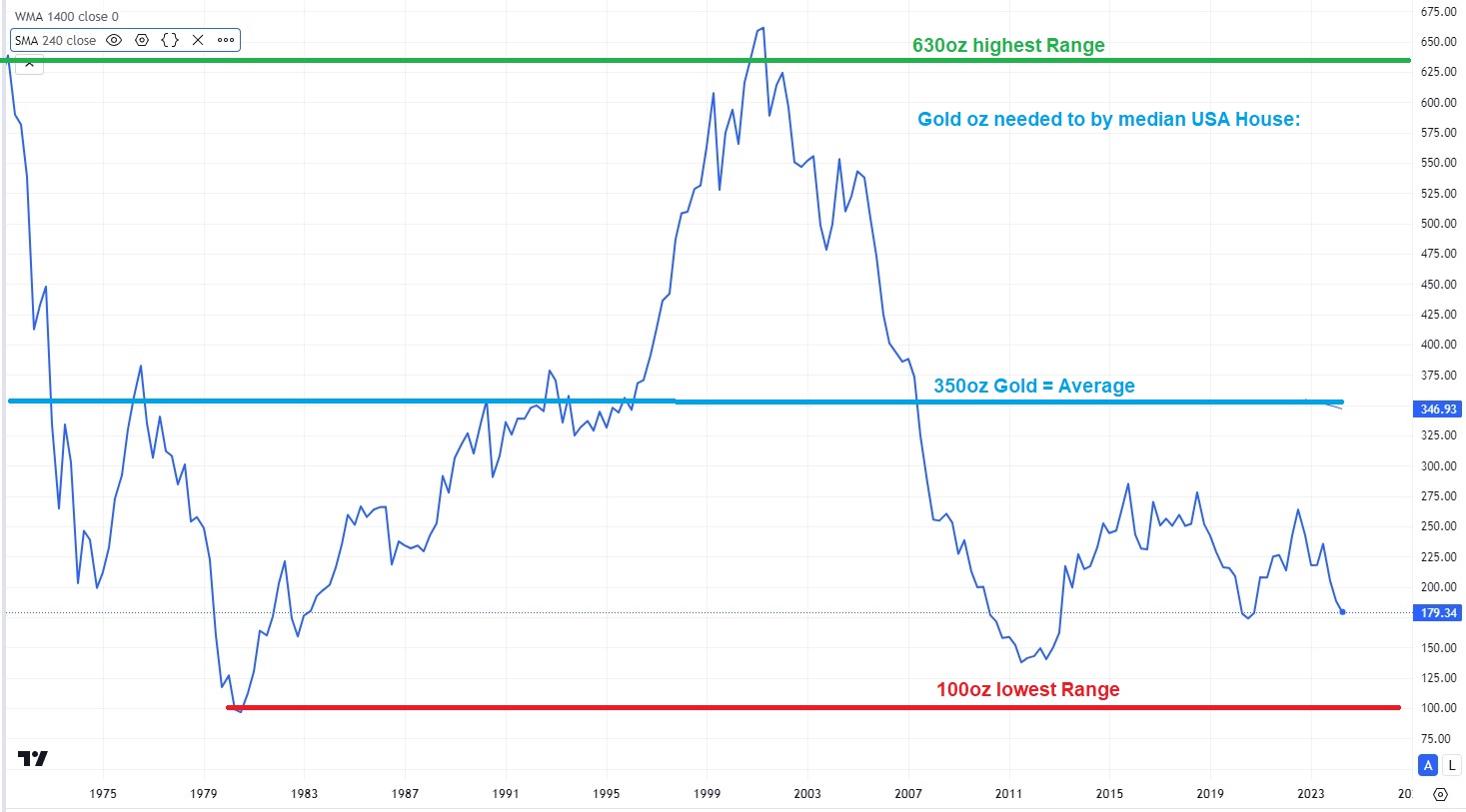

Gold vs Mediam House Price (MSPUS) - number of Gold oz needed to buy a median USA House is stable around 350 oz (between 100 and 630oz):

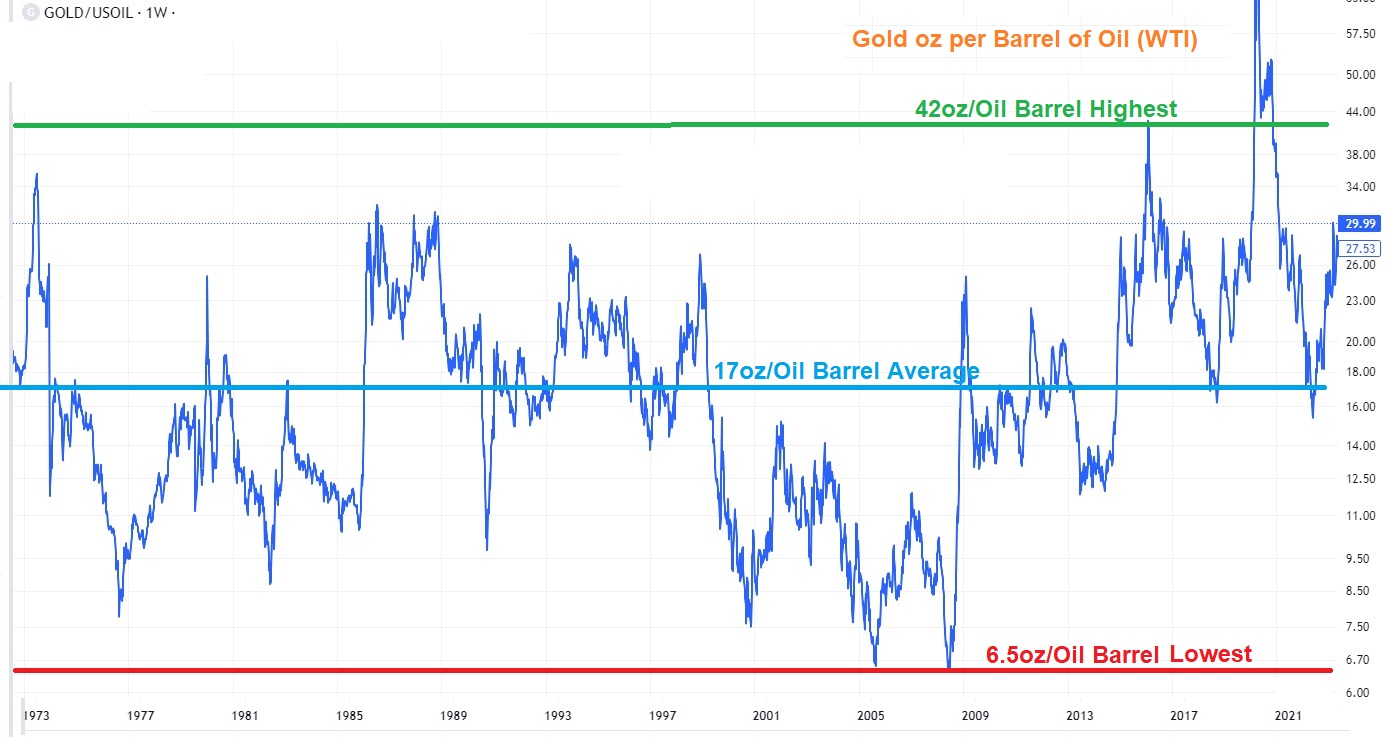

Gold vs Oil Price (oz per Oil Barrel=42Gallons) - in range 6.5 to 40oz - Average 17oz)

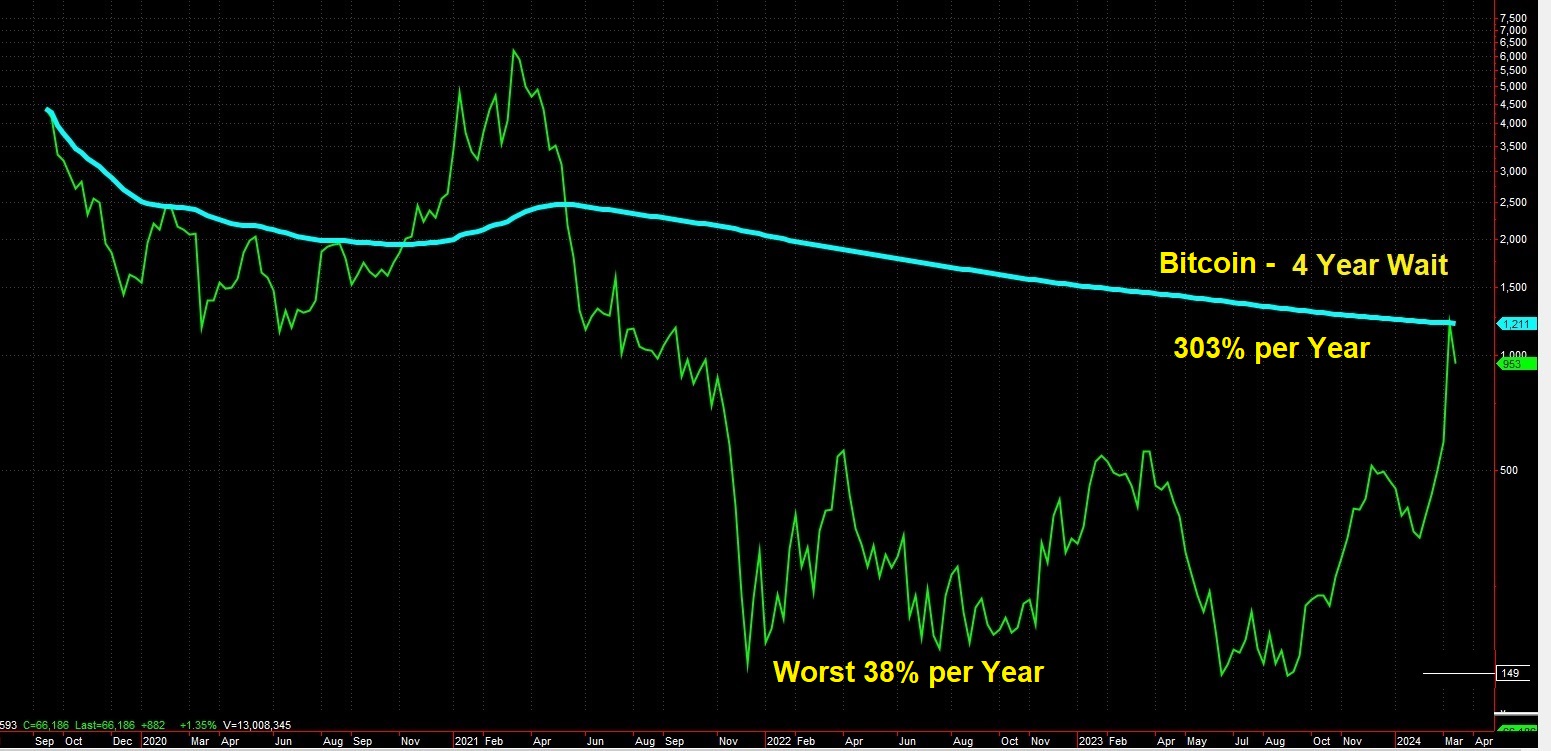

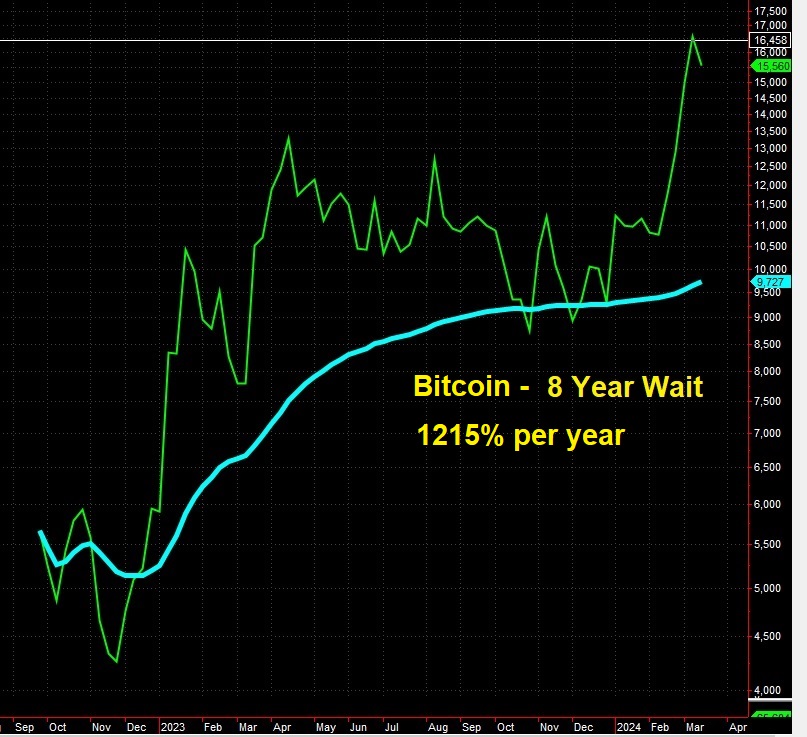

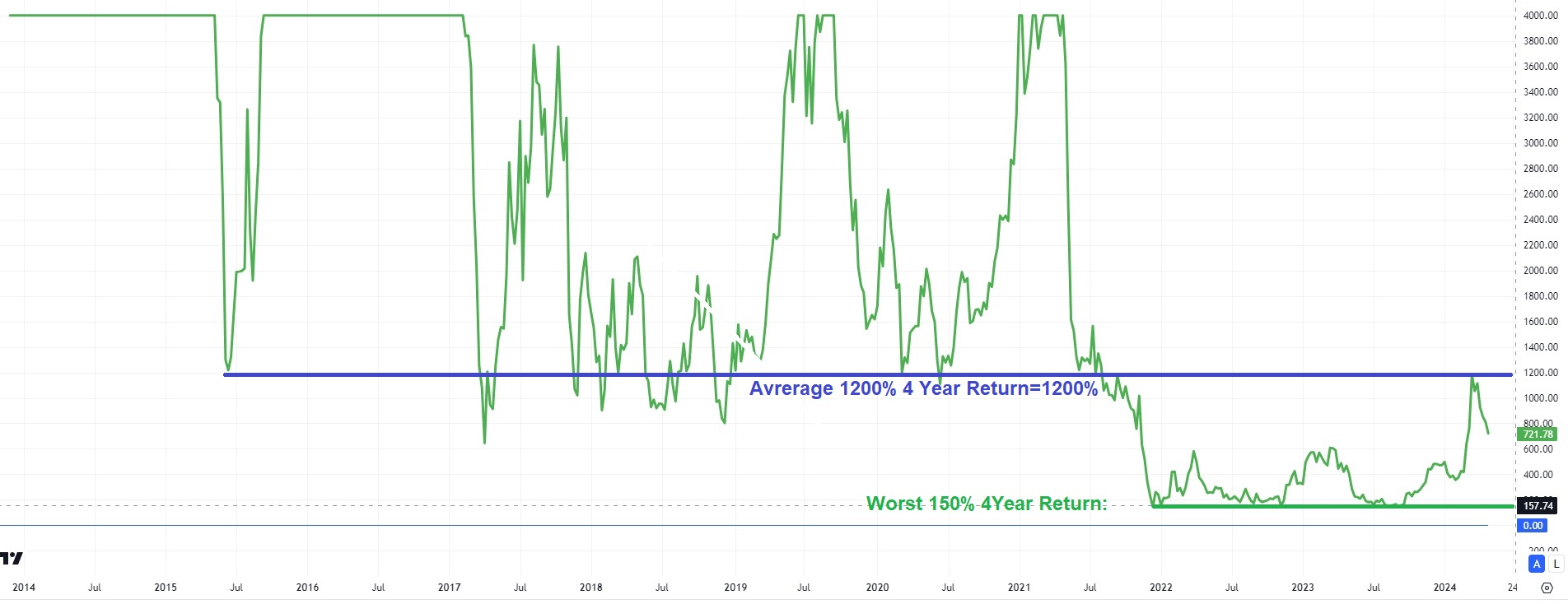

The Big Change: Bitcoin Investment 4 Year Returns:

Bitcoin is the ONLY investment in the world which has never lost in a 4 year period

instead it gained on average 1200%(12x) - worst result is 160%(2.6x) after 4 years - best 4000%(40x):

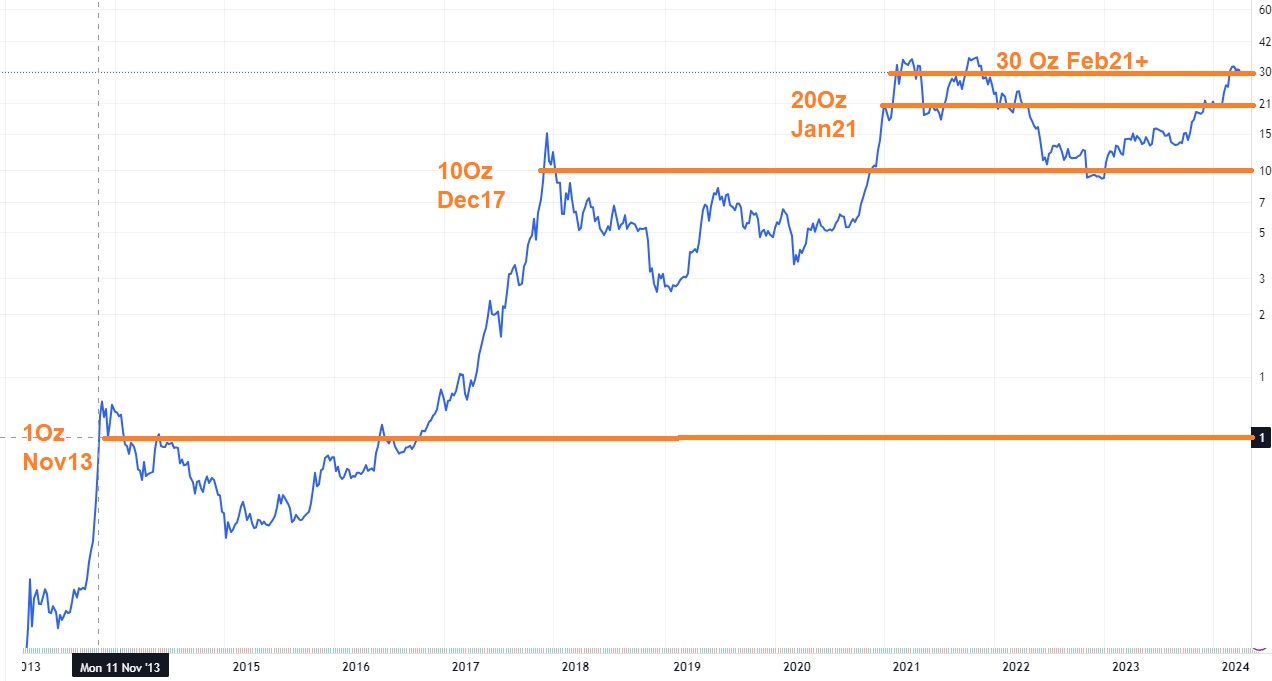

reaching parity (1x) May 2017 and now 12x:

reaching parity (1x) Oct 2017 and now close to 4x:

reaching half parity (50%) Dec 2017 and now close to 1.5x:

Dow Jones had many dangerous drawdowns of 35% or even 85%:

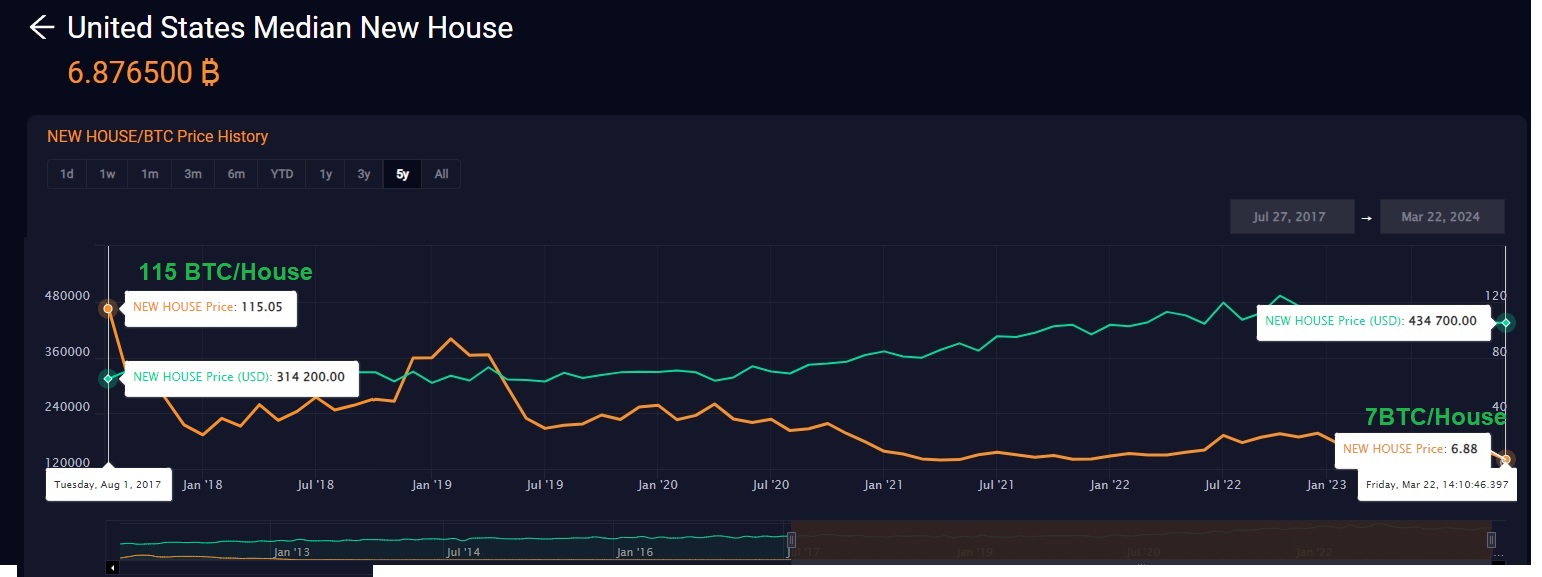

reaching now less than 5 bitcoins to buy an medium house - from 2000x in Jul 2023 (FRED:MSPUS / BITSTAMP:BTCUSD)

■ In 2017 you needed 115 Bitcoin to buy the mediam House - but now you need only 7 Bitcoin!!! (switch SATS off)

■ Bloomberg/Haver Analytics Research

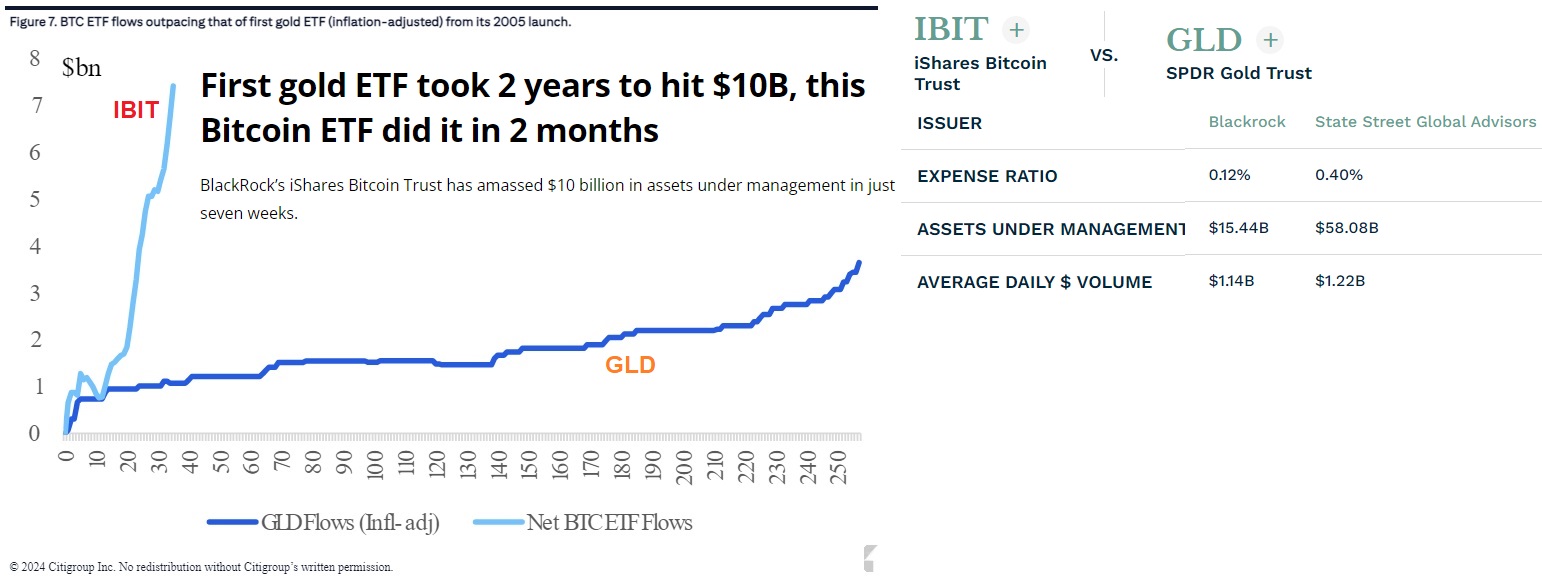

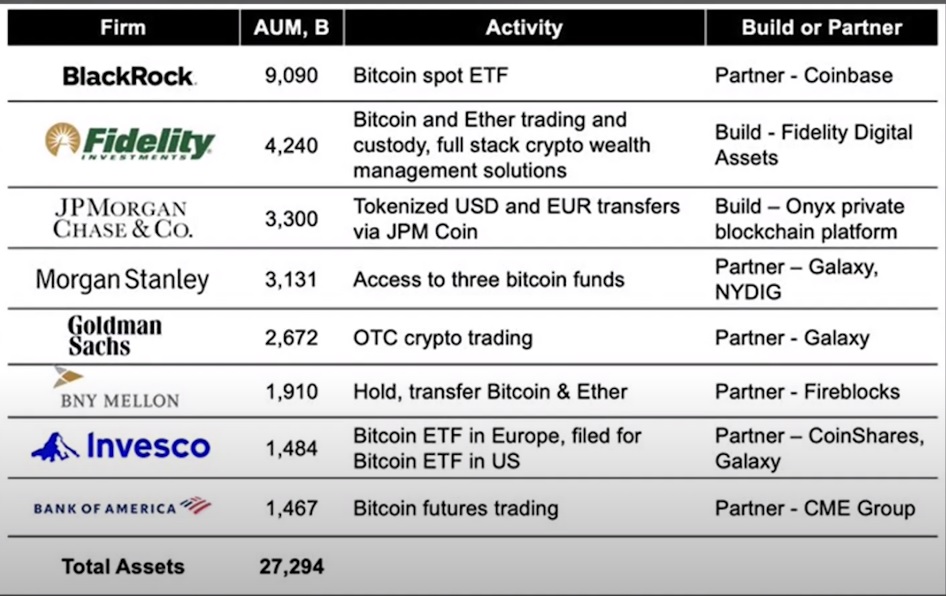

■ These Bitcoin ETF's are the most successful Fund launches ever since launch Jan11,2024: Avg $500mill/day - surpassing the $27Billion of previous ETF (Gold etc)

■ First gold ETF took 2 years to hit $10B, this Bitcoin ETF did it in 2 months LarryFink(IBIT) Fastest growing ETF in HISTORY! I am very bulling on the long term viability of Bitcoin. Unexpected Retail Demand

■ The ETFs accumulatied 450,000 BTC Worth Over $30B in 45 days = or 11 times the daily BTC production - 10,000 BTC each day on average - but only 900 are produced each day!

■ Best ETF Funds in the entire 30 year History:

■ This was only possible because GBTC with 600,000BTC sold appox 50% to these ETF's, but very soon these GBTC Bitcoion will run out and BTC price has to explode!

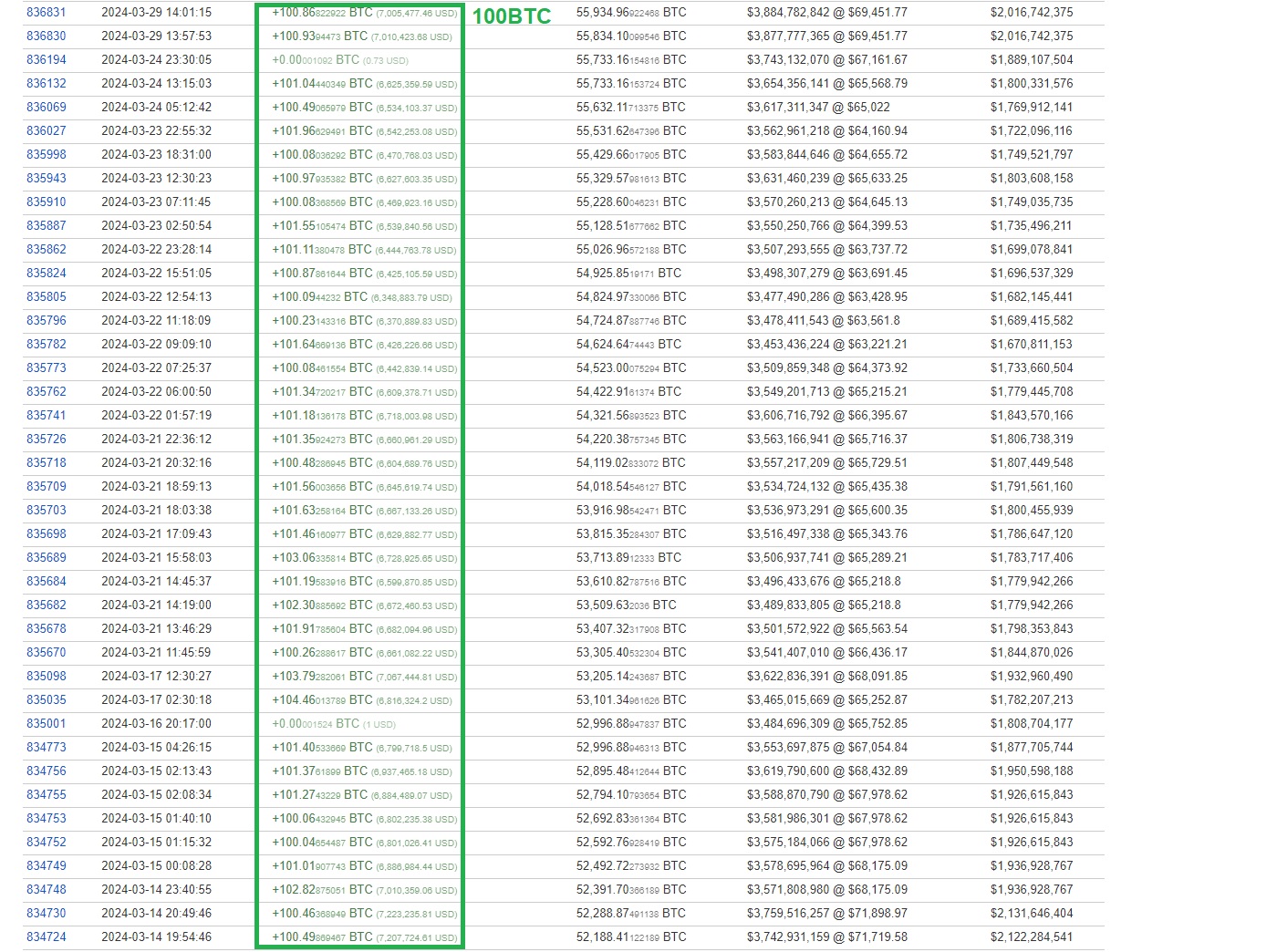

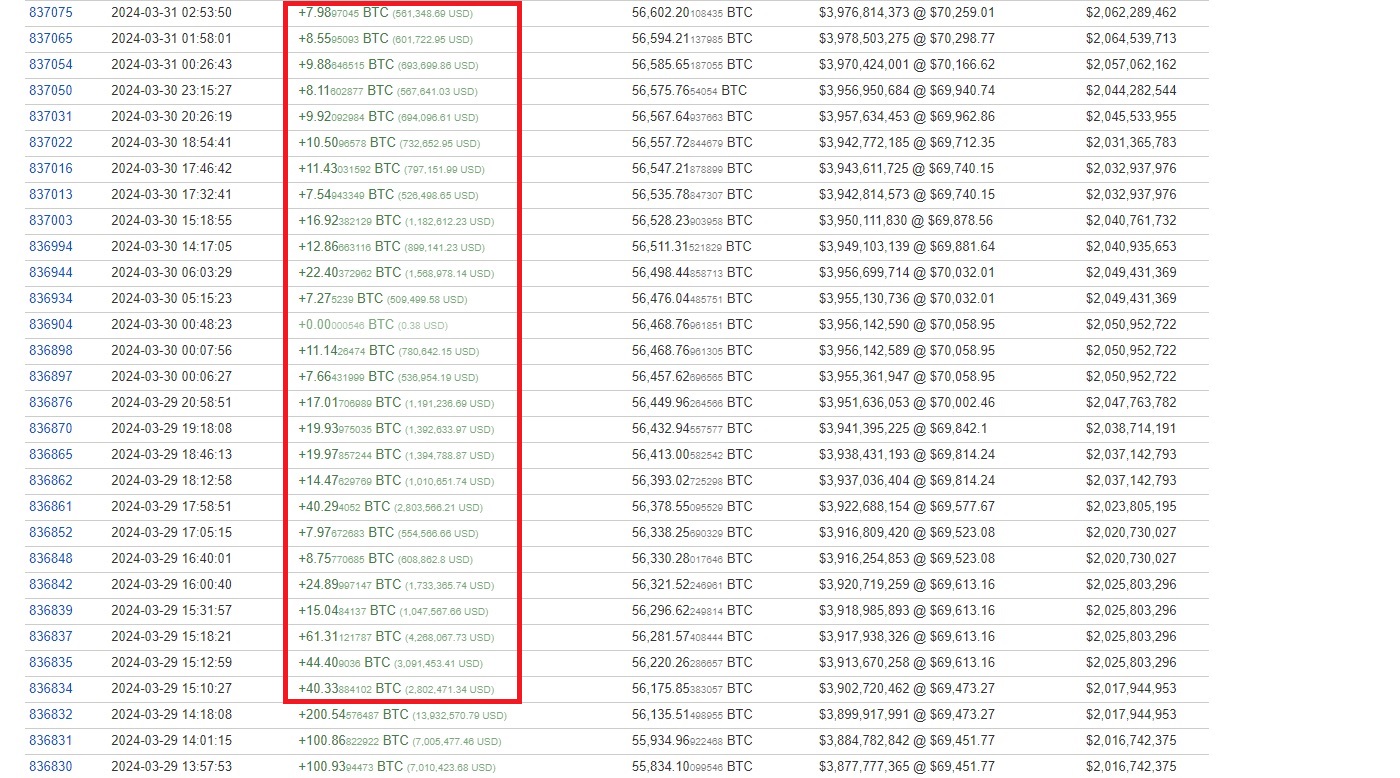

■ LargeWallets: RichList + Tether(75k=$5Bill) Mr100BTC(57k=$4Bill) MSTR(214k=$14.8Bill) + RobinHood(134k=10$Bill) + GovtBitfinex(94k=$$4bill) )

■ Mysterious Mr 100BTC has bought $3.5Billion in 53,610 Bitcoins in the last 3+months - Average price of $65,985

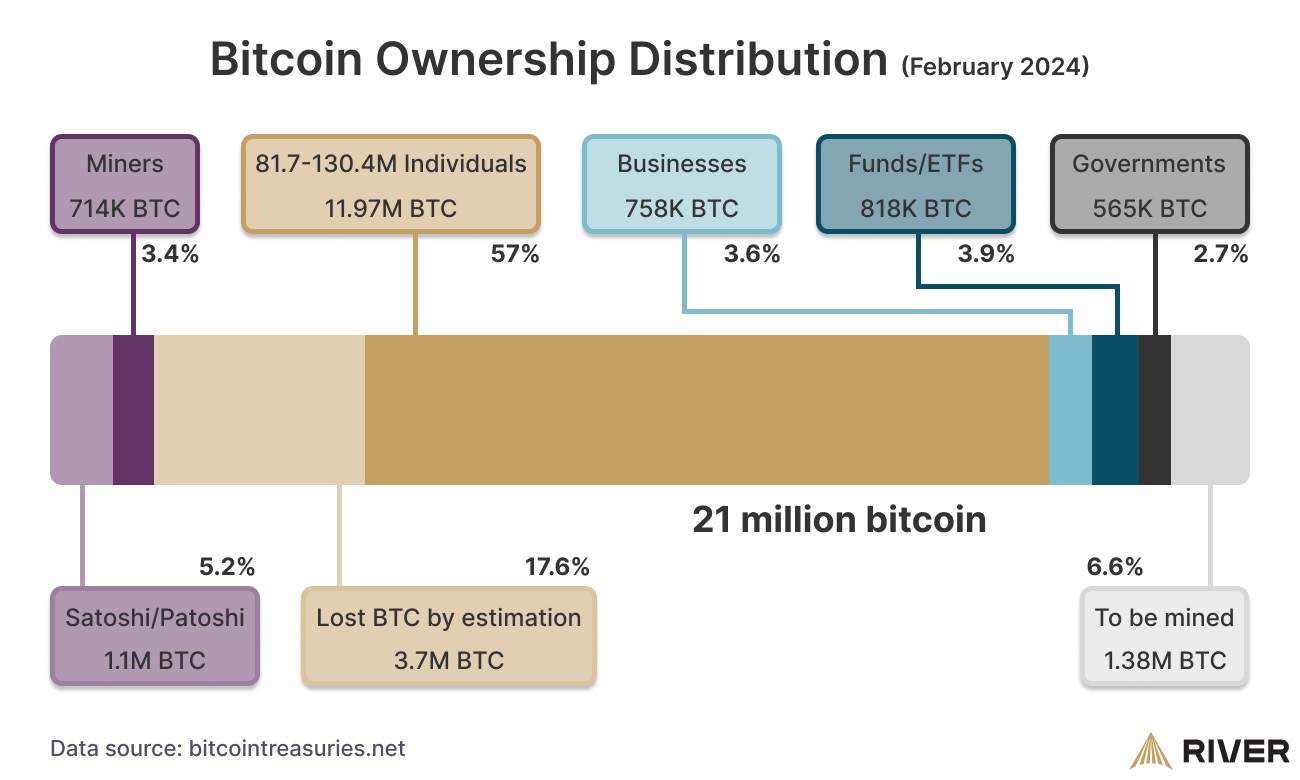

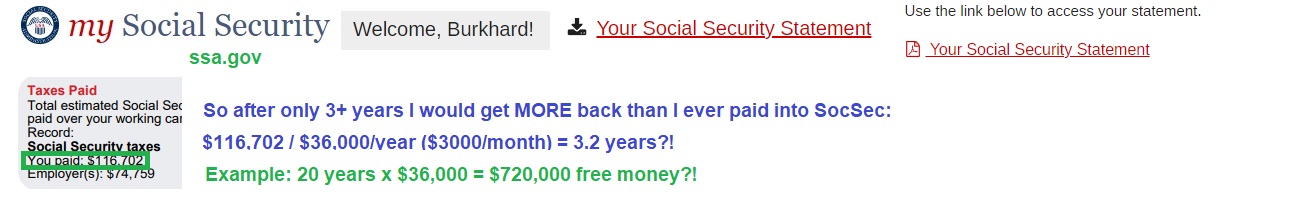

■ Only ~235,000 people in the world have currently at least one Bitcoin - I have 1.8(0.75 + 1.05)BTC +

■ There are ~56Million Millionaires in the World

■ Vanguard CEO Tim Buckley to retire by year-end after a distinguished 33-year career, including more than six years as CEO Mar 1,2024 after claiming:

"Bitcoin Is Too Volatile And It's Not A Store Of Value" - Not offering ANY Bitcoin ETF

$7.2Trillion asset manager Vanguard continues to shun Bitcoin ETFs as CEO announces retirement

“What surprises me most is they announced Buckley’s retirement without naming a successor,” said Jeff DeMaso, editor of The Independent Vanguard Advisor.

“Why not wait three months, find a successor and make just one announcement?” he added.

■ Vanguard CEO was fired because of missing the Bitcoin Investment opportunity:

"Vanguard CEO Tim Buckley Says "Bitcoin Is Too Volatile And It's Not A Store Of Value" — Asks If It Belongs In A Long Term Portfolio"

■ Current Bitcoin Price Chart

BTC:16k(Nov22) 32k(Oct23+One Year) 48k(Feb12+4Month) 64k(Feb28+2Weeks)

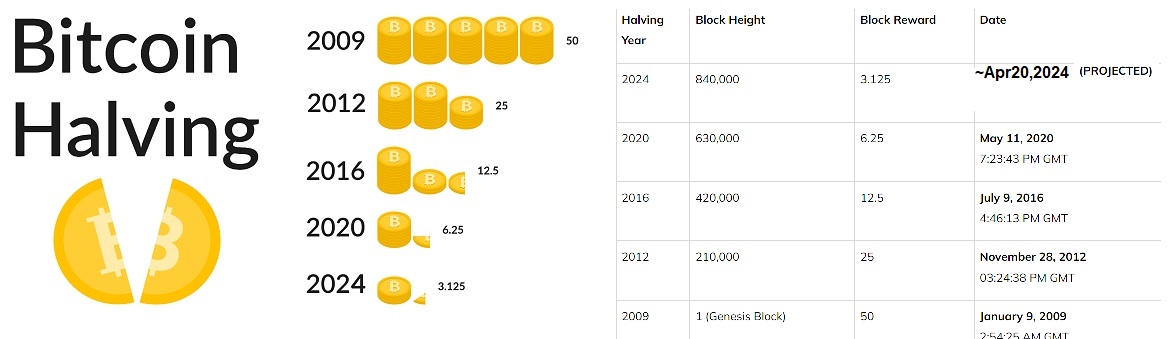

■ Bitcoin: takes 120years to rebuild 19.6mill inventory: 144 blocks/day (10minutes/block) x 3.125 = 450/day

64,300/year - previous 4 years 900/day = 328,700/year = 60years

Bitcoin production will crash from 900 to 450 per day Apr 20, 2024

■ On Apr 20th only 450 BTC will be procduced each day exploding the price over time to DOUBLE!

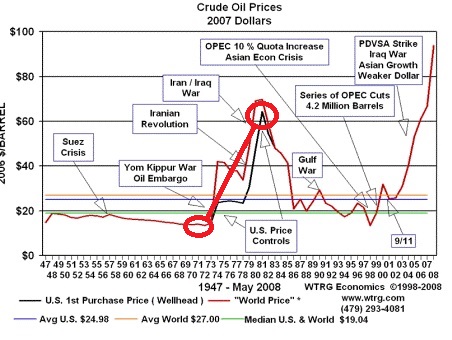

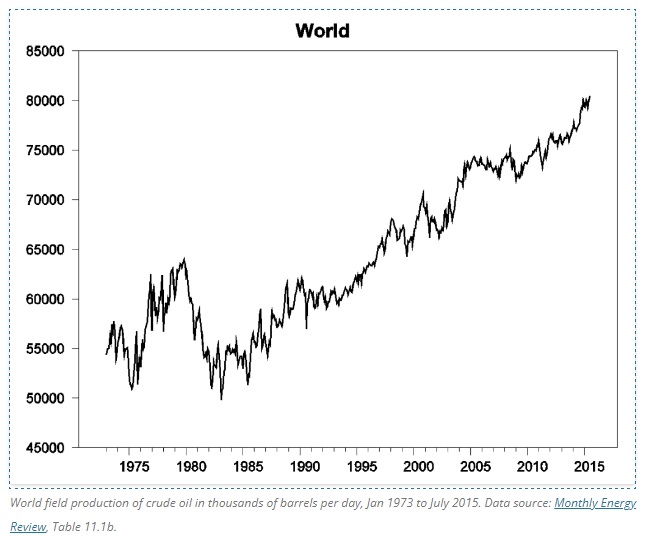

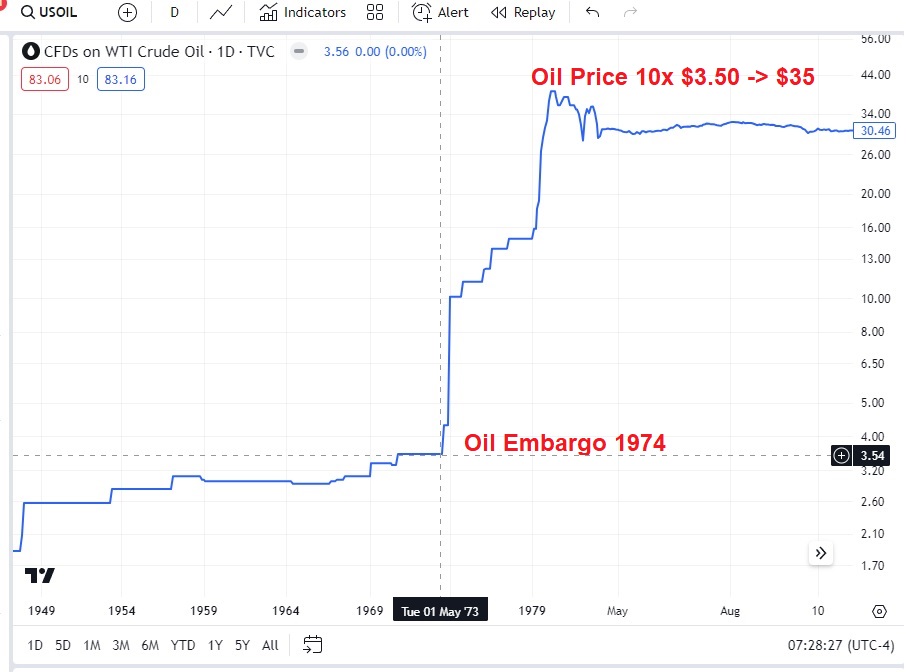

■ Imagine a permanent Oil Embargo every 4 years!

■ Halving Clock

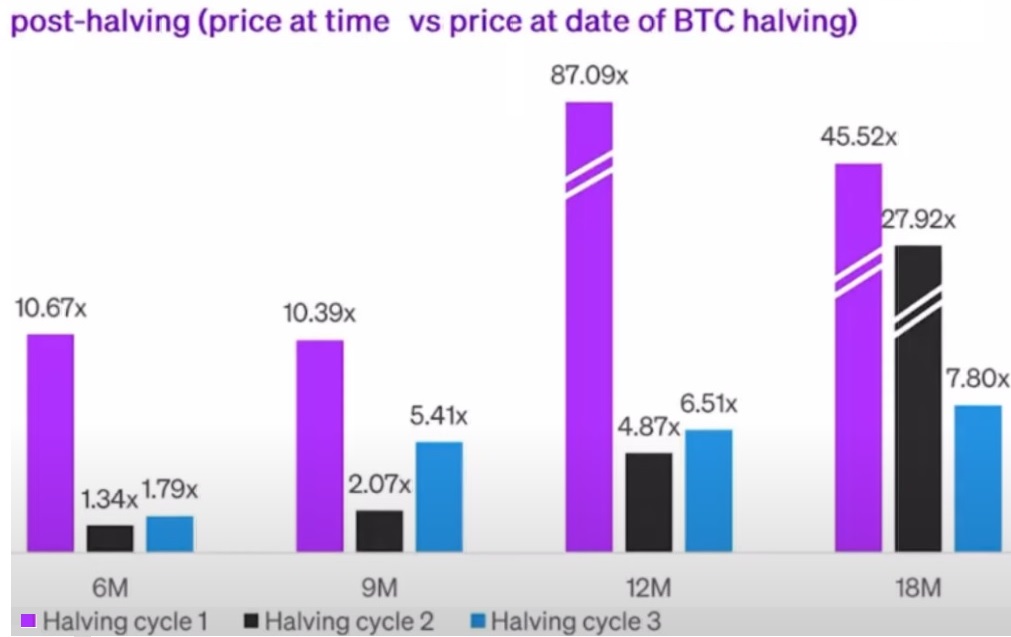

■ Returns after Halving 6, 12, 18months

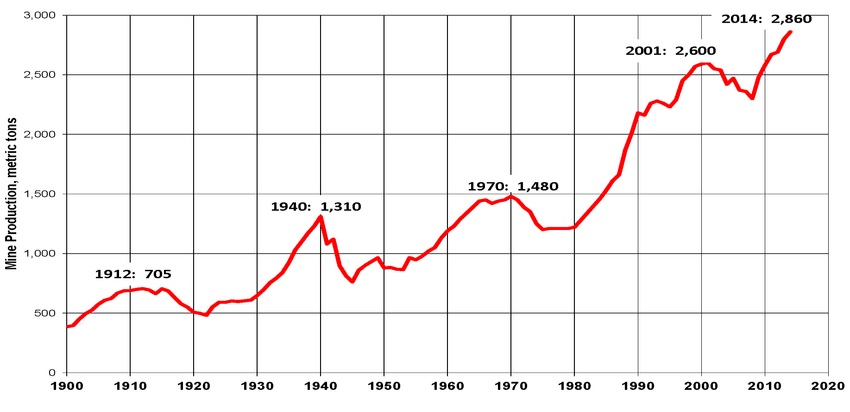

Gold:

Takes 65 years to recreate gold inventory: 201,296 tonnes inventory / 3,100 tonnes/year 200Year Chart doubled from only ~1500 tonnes:

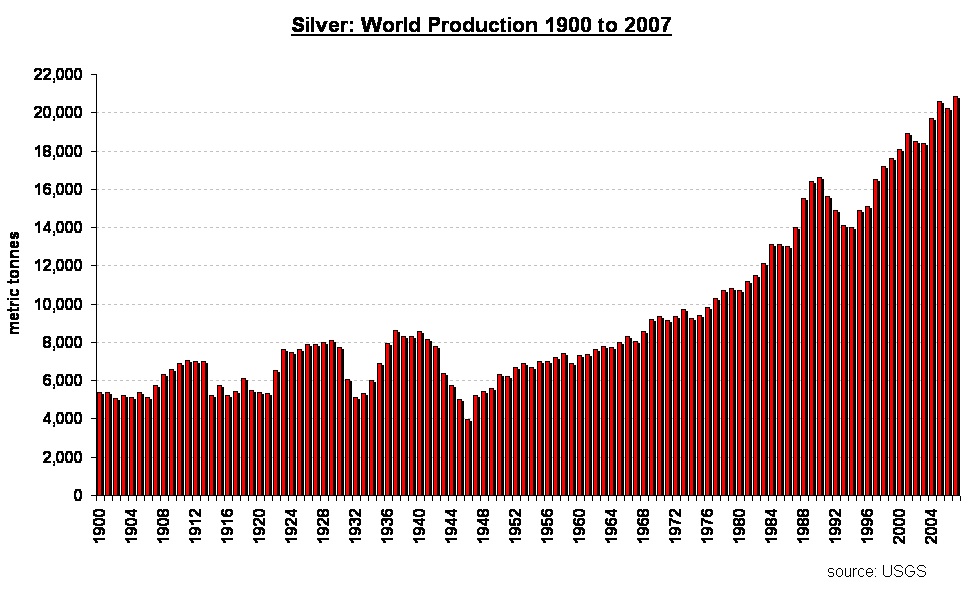

Silver:

Takes 67 years to recreate full silver ever mined inventory(no storage): 1,740,000 tonnes / 25,790 tonnes/year - but only 610,000 tonnes = 26years left!

OIL

■ Imagine a permanent Oil Embargo every 4 years! - also doubled recently:

|

|

|

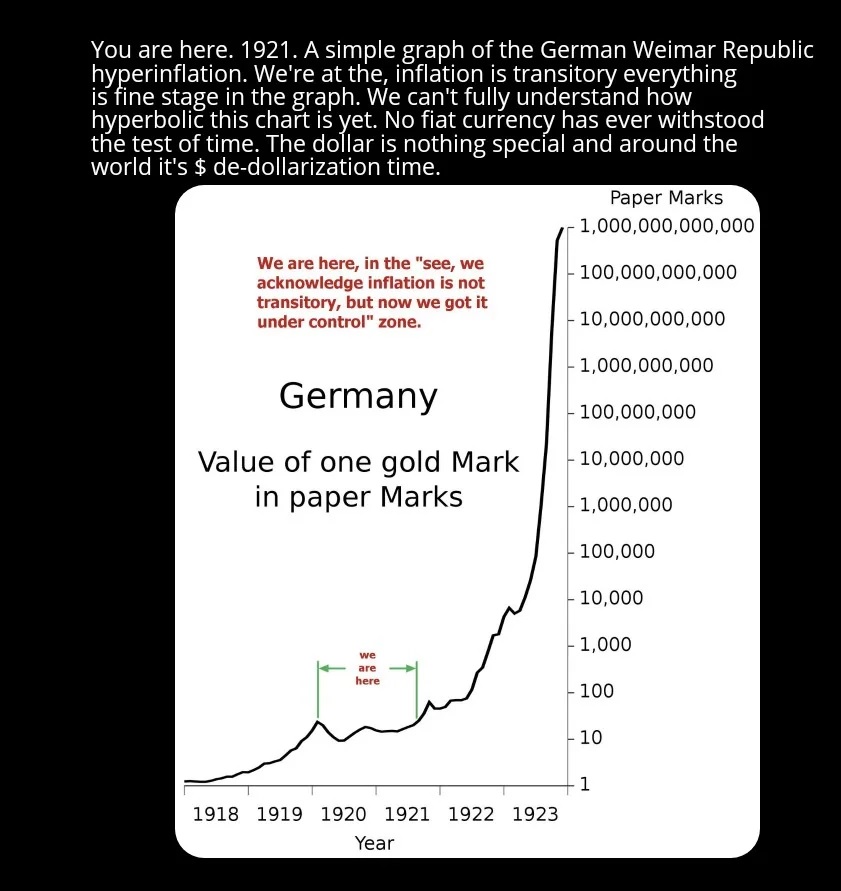

last "Stable" Period:

Hyperinflation after last "Stable" Period:

You are here. 1921. A simple graph of the German Weimar Republic hyperinflation.

We're at the, inflation is transitory everything is fine stage in the graph.

We can't fully understand how hyperbolic this chart is yet. No fiat currency has ever withstood the test of time.

■ Bitcoin ownership overview

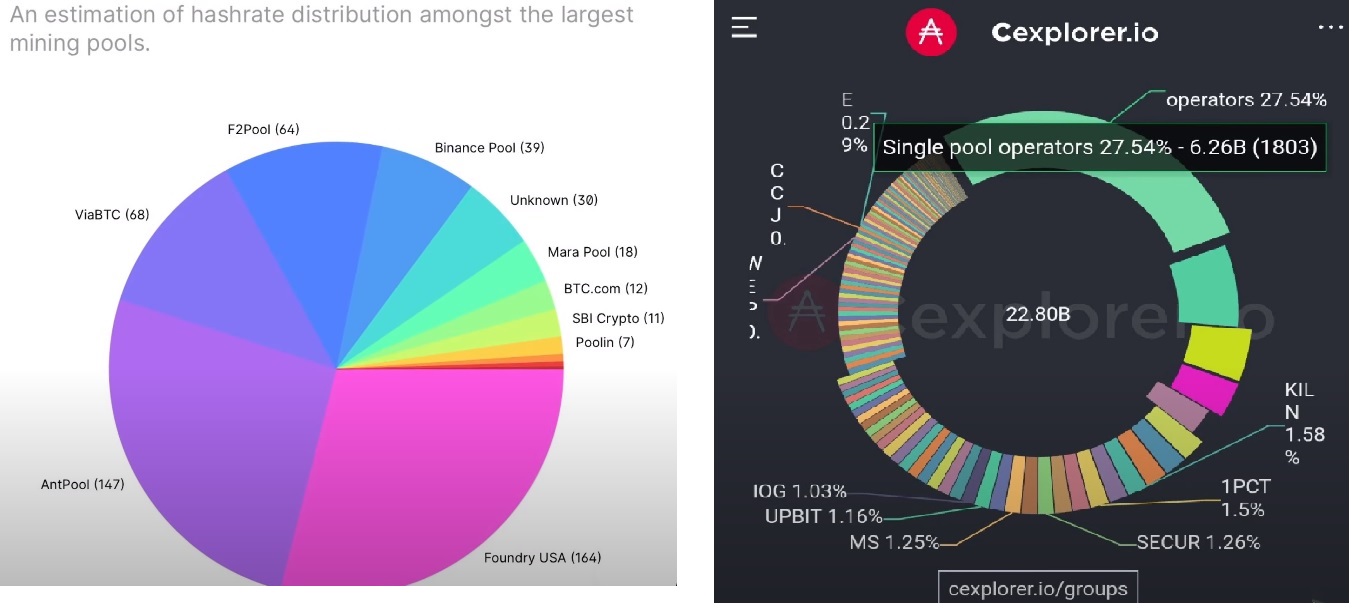

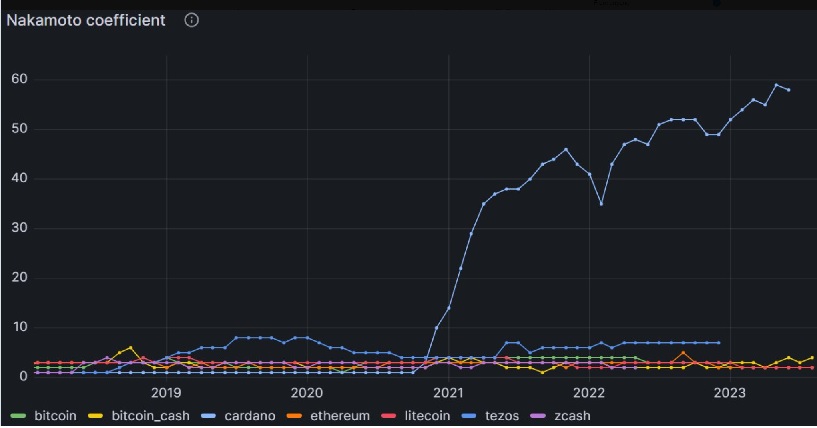

ADA vs BTC Decentralization: @LucisCIC

See Nakamoto Coefficient

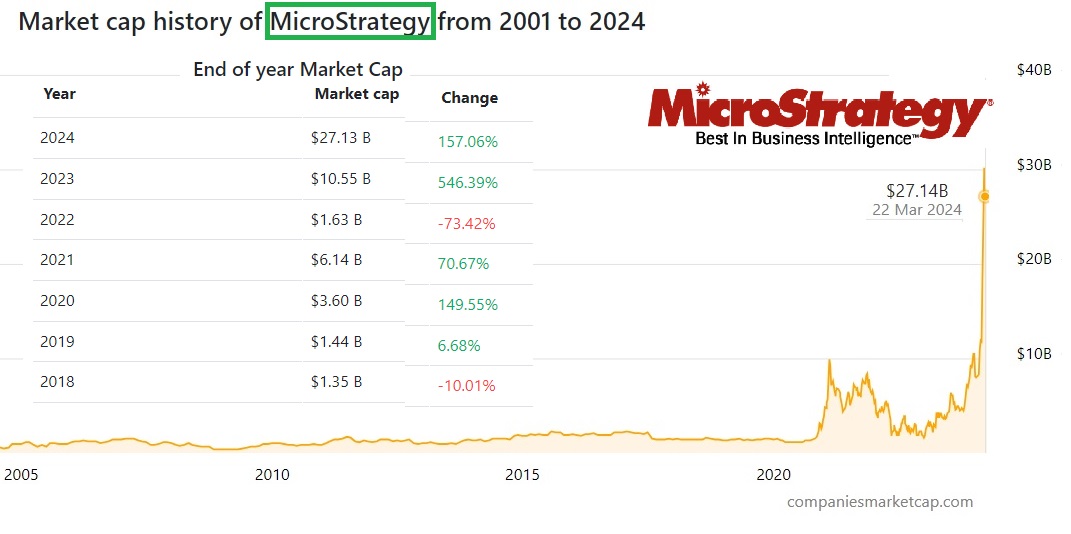

■ MicroStrategy(MSTR) started to accumulate now 214,246 bitcoins for $7.53Bill (avg 35,150/BTC) now 65,000 or $13.9Bill - a 85% gain

■ MicroStrategy(MSTR) market cap went from 1.2Bill(2020) to $27Bill in 4 years

■ MicroStrategy listing in the S&P 500 index could expose millions to Bitcoin - MSTR will be soon in the SP500 Index - which means Bitcoin is then part of the SPY Index!

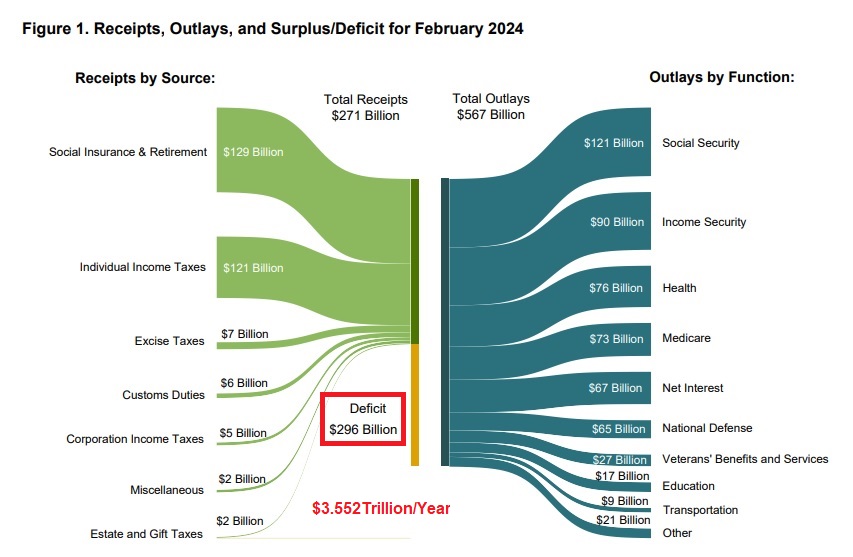

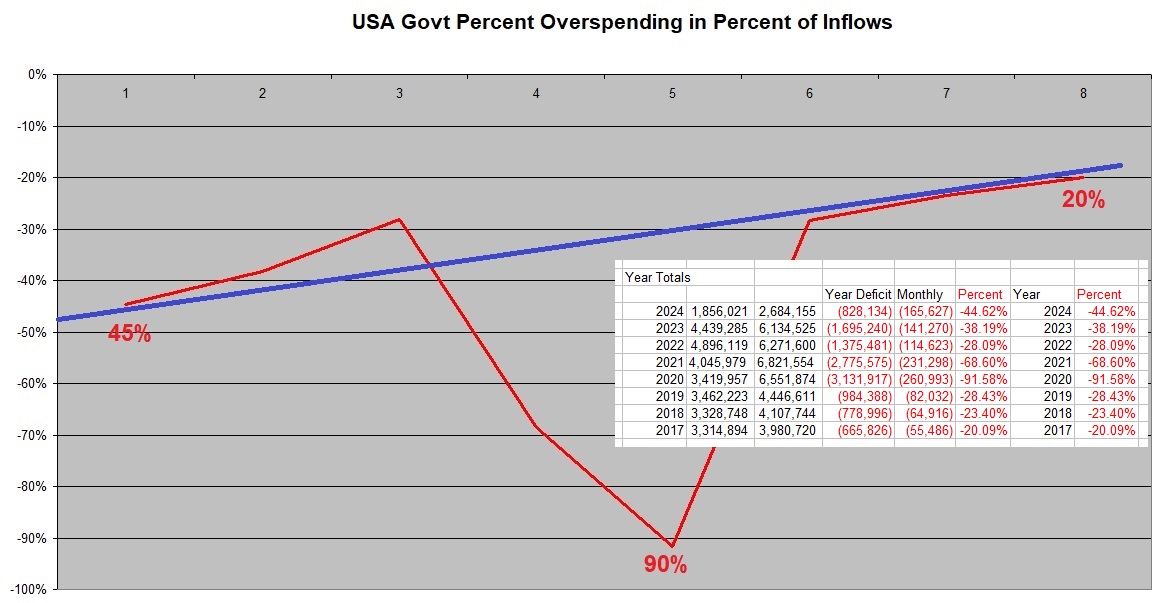

■ A total of 900$Trillion of Investment Funds is looking for the best Investments:

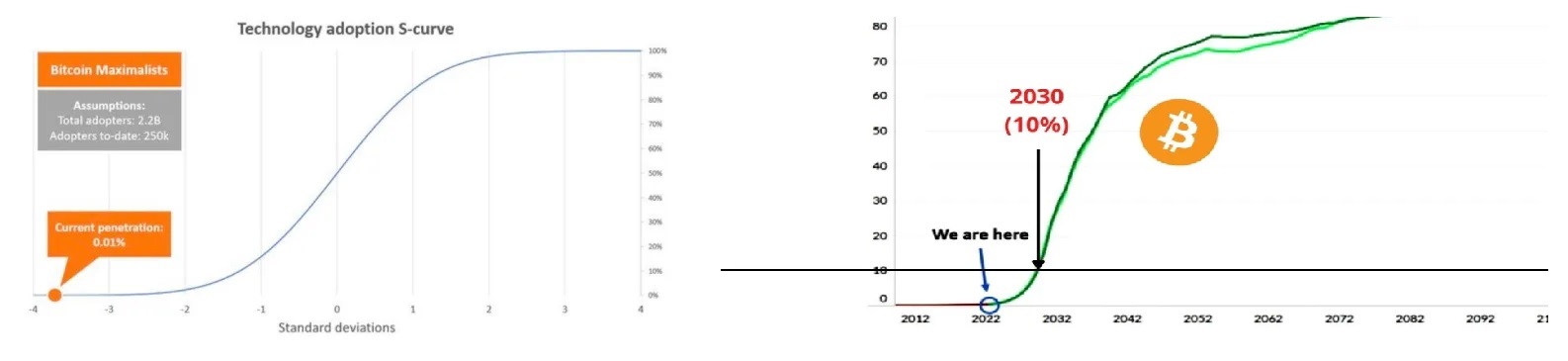

■ S Curve still very early:

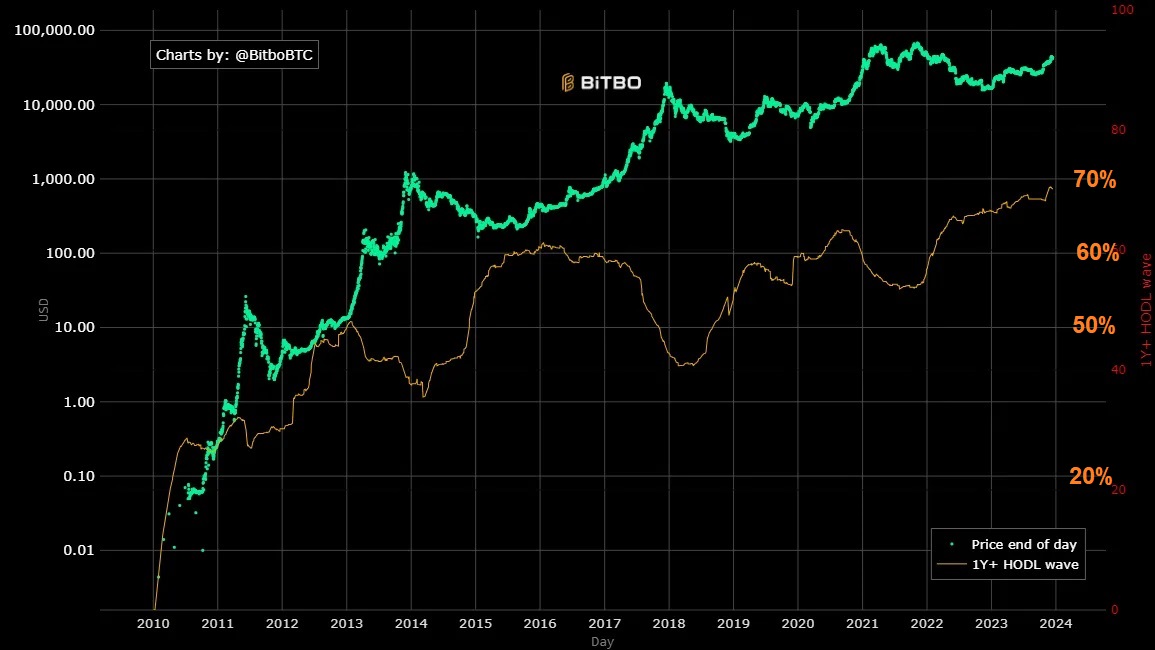

Highest HODL Wave in Bitcoins History

My portfolio contains

■ contains BTC (18%) ETH(10%) ADA(71.5%) SOL(1.5%)

■ Overall return after ONLY 6 Months is already 109% ($121k profit)

■ MSTR + IBIT returned already ~$10,397 after 10 days

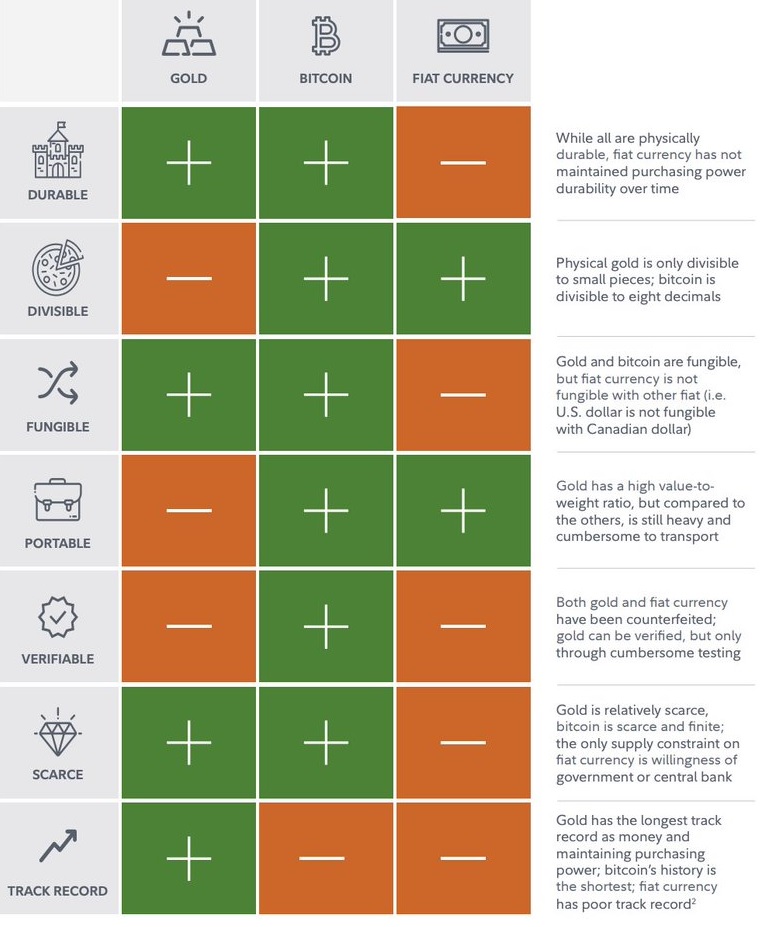

Bitcoin is the best Money Invented

Valuable: Diamonds, Rolex Watches, Paintings, Baseball Cards, Baseball Catch,

Price Volatility is NORMAL for new startup and new technologies - Example AAPLE Computer (AAPL)

Profit went from $94Bill (2015) to 173B(2024) 84% but price went from $30 to $180 = 600%

■ Can only sell entire house - not only a portion!

■ When price appreciates - you pay more taxes + Insurance etc

■ House costs Maintenance (Roof, Garage Door, AC, Patio, Paint etc)

■ Increasing House Insurance

■ Golden prison:L bought with 3.5% APR - cannot sell because new house now 7+% Mortage rates!

■ HOA Fees

■ Govt Bitcoin Dashboard

■ El Salvador new Singapore IMF Slavery

■ El Salvador paid off its debt to the IMF 900 million dollars because of their investment in Bitcoin to be launching hopefully the Bitcoin mining from volcano energy volcanic volcanic energy so super energy friendly way to mine Bitcoin

■ El Salvador Volcano Bond up 200%

■ El Salvador Has Thousands More Bitcoins Than Previously Known Wallet 5705BTC 32ixEdVJWo3kmvJGMTZq5jAQVZZeuwnqzo

■ El Salvador pays back maturing $800 million bond

■ One particularly interesting development that combines infrastructure investment with international business partnerships is the Lava Pool, a public-private partnership launched in October 2023 to mine Bitcoin with geothermal energy.

The project will combine Luxor’s experience with mining-related support and software development with Volcano Energy’s commitment to building the actual hardware infrastructure.

The first ground broken on this project has involved the construction of new mining facilities in El Salvador’s second-largest city, Metapán, and although this preliminary mining pool is powered by solar and wind energy,

the ultimate goal is to harness El Salvador’s substantial volcanic activity.

■ How Is El Salvador's Bitcoin Legal Tender Stance Viewed by the IMF?

■ El Salvador 85% President Vote crushing gangs & crime

■ How the World’s Most Dangerous Country Solved Murder

■ The IMF wants El Salvador to choose between Bitcoin and a bailout

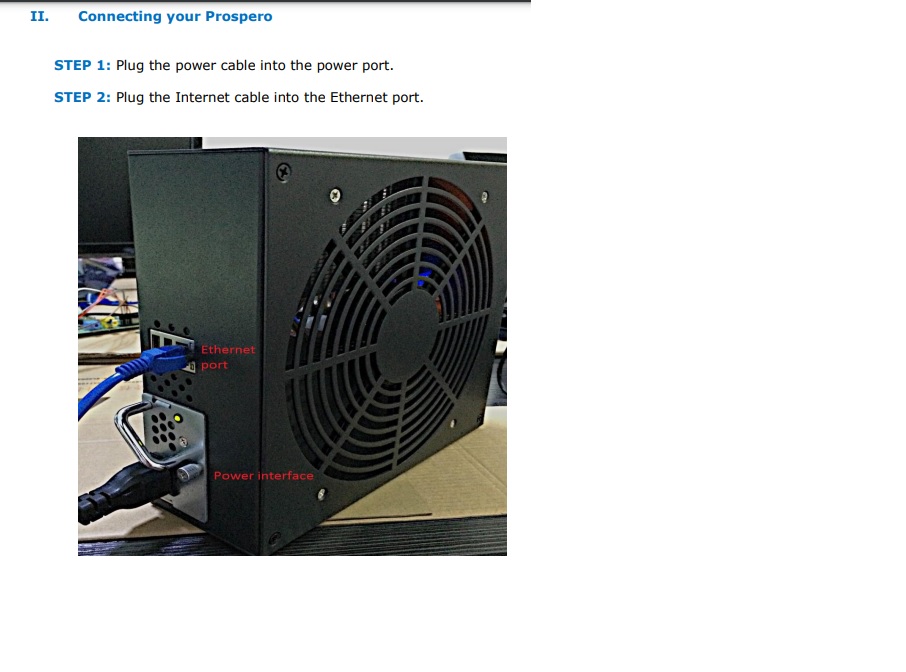

Dec 27, 2013: BAX1 Black Arrow Prospero X-1 (100Gh/s) (2) @ $352 / 0.5319BTC = $704 / 1.0638BTC Subtotal: $704 / 1.0638BTC Shipping $50 / 0.0755BTC Order Total: $754 / 1.1392BTC

Mar 5, 2014: Transfer from IC 2.00 BTC @ $592.35 each+2x$6 Fee Feb 27, TrxCode FJAMRX06

■ 27Trillion Gorillas enter the Crypto/Bitcoin Market:

■ Live Transactions

■ Mempool

■ Cardano

■ World Map BTC ETH ADA

■ Mining explained

■ Bitcoin dynamic Block list