Diamond Backtesting with Walk Forward Manager

(BTWFMgr)

Strategy Code Preparation

(Professional Software Solutions)

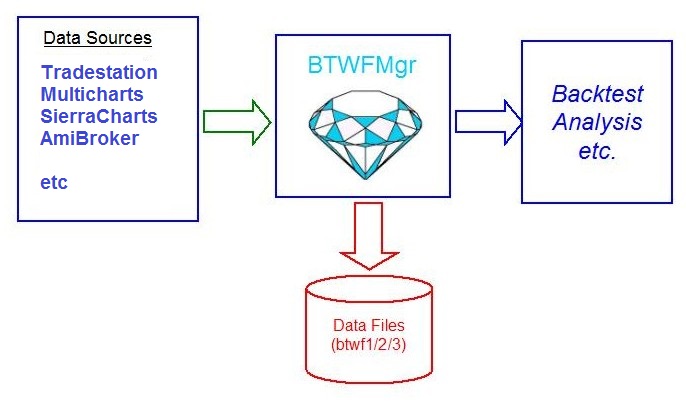

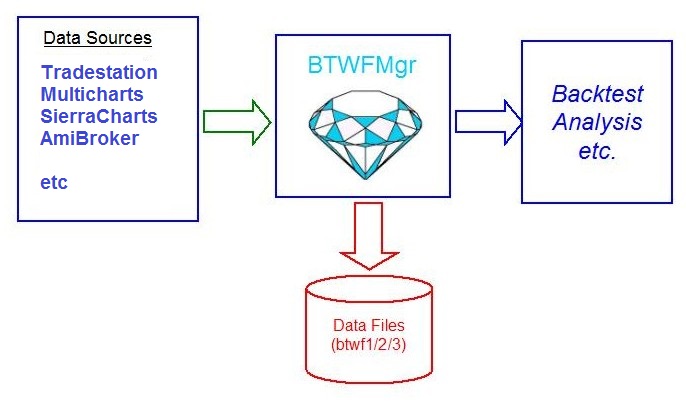

BTWFMgr allows you to easily add a small backtesting data

collection section to your

strategy EasyLanguage®

code

using the C:/BTWFMgr/BTPrep.exe

Strategy preparation Module.

See the Code example below - BTWFMgr can work with

many different data sources,

because

BTWFMgr uses a modular appraoch, which translates the various data sources into a standard btwf1/2 format:

Example BTWFMgr added data

collection

segment:

//====== WALK-FORMWARD-OPTIMIZATION DATA COLLECTION SECTION ======

external: "C:\BTWFMgr\PSS_BT.DLL", int, "PSS_BT", LPSTR,LPSTR,LPSTR,IEasyLanguageObject;

DefineDLLFunc: "C:\BTWFMgr\PSS_BT.DLL", int, "PSS_BTSetExit", FLOAT;

Vars: nRetWFO(0),MinDistance(15),WalkForwardVar(""),WeekDay(1),nMinMove(MinMove/pricescale);

Array: arrPSSBTInp[100](0), arrPSSBTVal[30](0);

if nBTWFMgrExport > 0 then begin

PSS_BTSetExit(Open);

if nBTWFMgrExport = 3 AND Marketposition = 0 then

Buy("L") 1818 shares next bar at market;

WeekDay = DayOfWeek(Date);

if WeekDay = 0 THEN

WeekDay = 7; //Sunday

if GetAppInfo(aiOptimizing) = 1 then begin

//------ Setup Input Name List

if WalkForwardVar = "" then begin

WalkForwardVar = "RSILength";

WalkForwardVar = WalkForwardVar + "/OverSold";

WalkForwardVar = WalkForwardVar + "/OverBought";

WalkForwardVar = WalkForwardVar + "/EMALength";

WalkForwardVar = WalkForwardVar + "/LossAmt";

WalkForwardVar = WalkForwardVar + "/GainAmt";

if nBTWFMgrExport = 1 OR nBTWFMgrExport = 3 then begin

WalkForwardVar = WalkForwardVar + "/*TimeOfDay/WeekDay";

// WalkForwardVar = WalkForwardVar + "/YourContextVariables";

end;

end;

//------ Transfer current Strategy Input Values

arrPSSBTInp[0] = RSILength; // Strategy Input#01

arrPSSBTInp[1] = OverSold; // Strategy Input#02

arrPSSBTInp[2] = OverBought; // Strategy Input#03

arrPSSBTInp[3] = EMALength; // Strategy Input#04

arrPSSBTInp[4] = LossAmt; // Strategy Input#05

arrPSSBTInp[5] = GainAmt; // Strategy Input#06

arrPSSBTInp[6] = Time; // Context Input#01

arrPSSBTInp[7] = WeekDay; // Context Input#02

//------ Transfer Position Details

arrPSSBTVal[0] = 6; // Number of tracked Strategy Inputs

if nBTWFMgrExport = 1 OR (nBTWFMgrExport = 3 AND CurrentShares = 1818) then

arrPSSBTVal[0] = 8; // add Number of Context Variables

arrPSSBTVal[1] = (MarketPosition(0)*MaxShares(0));

arrPSSBTVal[2] = (MarketPosition(1)*MaxShares(1));

arrPSSBTVal[3] = EntryPrice(0);

arrPSSBTVal[4] = EntryPrice(1);

arrPSSBTVal[5] = ExitPrice(0);

arrPSSBTVal[6] = ExitPrice(1);

arrPSSBTVal[7] = PositionProfit(1);

arrPSSBTVal[8] = Commission + Slippage;

arrPSSBTVal[9] = nMinMove;

arrPSSBTVal[10]= BigPointValue;

if LastBarOnChart then

arrPSSBTVal[11] = 1 // Last Bar reached

else

arrPSSBTVal[11] = 0;

arrPSSBTVal[12] = BarNumber;

arrPSSBTVal[13] = BarType;

arrPSSBTVal[14] = BarInterval;

arrPSSBTVal[15] = nBTWFMgrExport;

arrPSSBTVal[16] = Date;

arrPSSBTVal[17] = Time;

arrPSSBTVal[18] = Open;

arrPSSBTVal[19] = High;

arrPSSBTVal[20] = Low;

arrPSSBTVal[21] = Close;

arrPSSBTVal[22] = Volume;

arrPSSBTVal[23] = BarsSinceExit(1);

arrPSSBTVal[24] = BarsSinceEntry(1);

arrPSSBTVal[25] = MarketPosition*CurrentShares;

arrPSSBTVal[26] = ExitPrice(2);

//------ Call Diamond Backtesting Data Collection Interface

nRetWFO = PSS_BT(Symbol,"PSS_RSISample"{Strategy},WalkForwardVar{InputNames},self);

end;

//------ Close new Positions in Potential Mode after MinDistance Bars

If nBTWFMgrExport = 1 then begin

If marketposition = 1 AND BarsSinceEntry >= MinDistance then

Sell ("LPot") next bar Market;

If marketposition = -1 AND BarsSinceEntry >= MinDistance then

Buy to Cover ("Spot") next bar Market;

end;

end; // End of Data Collection Insert

MultiCharts Example BTWFMgr added data

collection segment

The MultiCharts code is identical to the TradeSTation code

- except the DLL function declaration:

//====== WALK-FORMWARD-OPTIMIZATION DATA COLLECTION SECTION ======

external: "C:\BTWFMgr\PSS_BT64.DLL", int, "PSS_BTMC", LPSTR,LPSTR,LPSTR,IEasyLanguageObject,

LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,

LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,

LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT,LPFLOAT;

DefineDLLFunc: "C:\BTWFMgr\PSS_BT64.DLL", int, "PSS_BTSetExit", FLOAT;

and the he DLL function call:

//------ Call Diamond Backtesting Data Collection Interface

nRetWFO = PSS_BTMC(Symbol,"PSS_RSISample"{Strategy},WalkForwardVar{InputNames},self,

&arrPSSBTVal[ 0],&arrPSSBTVal[ 1],&arrPSSBTVal[ 2],&arrPSSBTVal[ 3],&arrPSSBTVal[ 4],

&arrPSSBTVal[ 5],&arrPSSBTVal[ 6],&arrPSSBTVal[ 7],&arrPSSBTVal[ 8],&arrPSSBTVal[ 9],

&arrPSSBTVal[10],&arrPSSBTVal[11],&arrPSSBTVal[12],&arrPSSBTVal[13],&arrPSSBTVal[14],

&arrPSSBTVal[15],&arrPSSBTVal[16],&arrPSSBTVal[17],&arrPSSBTVal[18],&arrPSSBTVal[19],

&arrPSSBTVal[20],&arrPSSBTVal[21],&arrPSSBTVal[22],&arrPSSBTVal[23],&arrPSSBTVal[24],

&arrPSSBTVal[25],&arrPSSBTVal[26]);

© Copyright 1998-2016, Burkhard Eichberger, Professional Software Solutions

All Rights Reserved Worldwide.